Finnish Real Estate Market Q4/2025 -

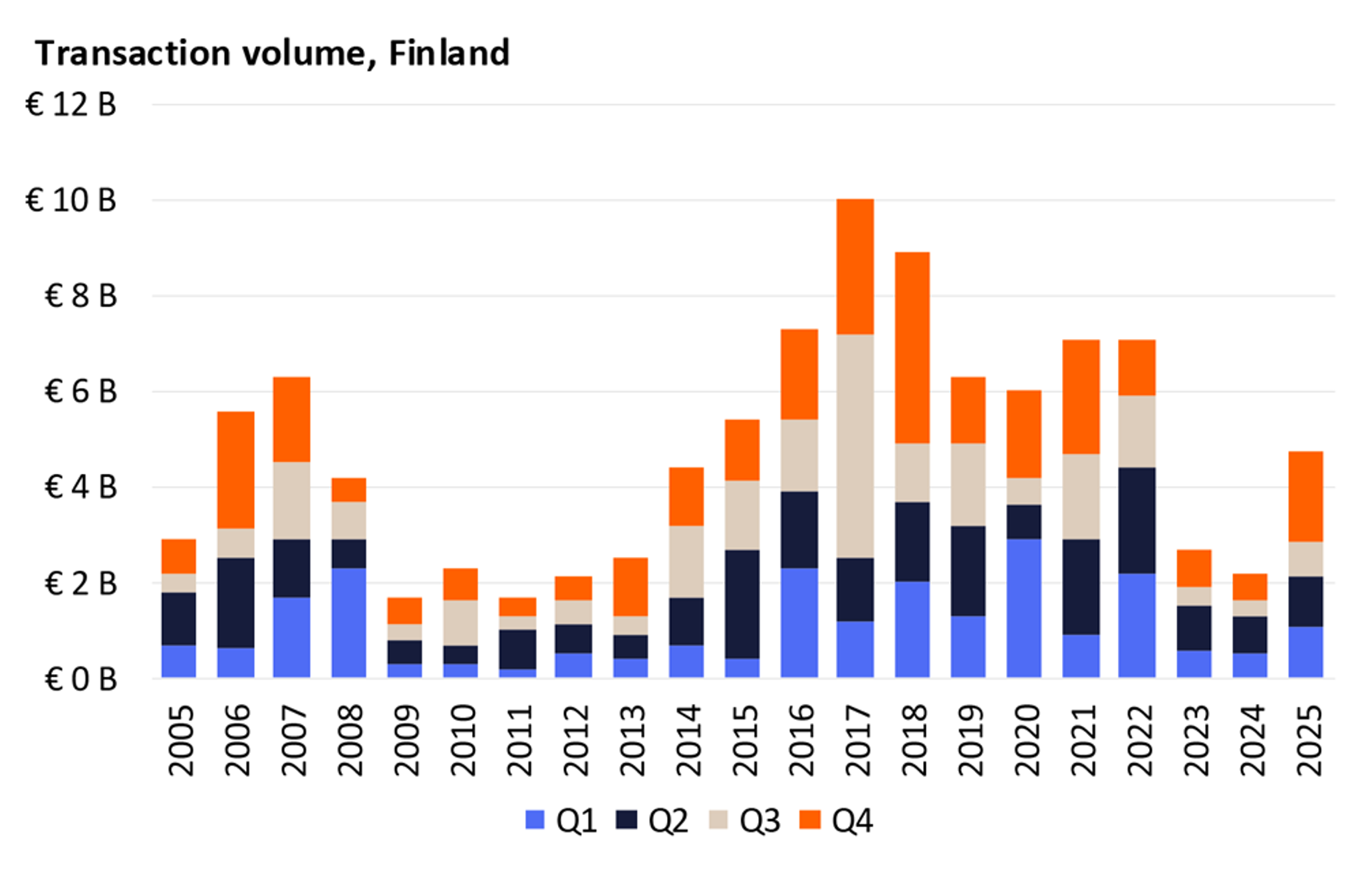

Recovery continues – foundations for growth strengthen. Momentum in the Finnish real estate investment market strengthened notably during Q4/2025. Following two exceptionally subdued years, the market has entered a recovery cycle, broadly in line with the rest of Europe. Full-year transaction volume reached EUR 4.6 billion, more than doubling compared with 2024. At the same time, the number of transactions increased by over 50%, signalling a broad-based improvement in market activity rather than a recovery driven solely by a handful of large deals.

Key highlights – Q4/2025

- The Finnish real estate market recorded a strong recovery in 2025, with transaction volume rising to EUR 4.6 billion, representing a 110% increase year-on-year.

- The final quarter of the year was particularly robust: Q4/2025 transaction volume reached approximately EUR 1.8 billion, the highest quarterly level recorded in 13 quarters.

- International investors returned decisively to the market, with foreign capital accounting for more than 50% of total transaction volume. Both new entrants and returning investors were active, with Swedish investors in particular re-emerging strongly.

- The share of portfolio transactions increased, reflecting growing appetite—especially among international investors—for multi-asset acquisitions.

Strengthening transaction activity

In 2025, Finnish real estate transaction volume increased to EUR 4.6 billion, representing growth of more than 110% compared with the previous year. The final quarter, traditionally the most active period for transactions, delivered approximately EUR 1.8 billion in volume, making Q4 the strongest quarter in 13 consecutive reporting periods.

Market recovery has been gradual but consistent. Portfolio transactions accounted for more than half of total annual investment volume, highlighting a continued shift toward larger, multi-asset deals. This trend intensified during Q4 and reflects an improving market in which investors seek scale and international capital plays an increasingly important role.

Several notable transactions were completed after October. Norwegian investor Storebrand entered the Finnish residential market through two separate acquisitions totalling approximately EUR 80 million, purchasing residential assets from Citycon and Toivo Group. Newsec acted as sell-side advisor in the first transaction. Swedish-listed Prisma Properties acquired a EUR 59 million grocery-anchored retail portfolio from Kesko, strengthening its position in the Finnish retail market. In the logistics sector, German investor Sicore Real Assets acquired a DHL Express logistics terminal developed by Urban Partners and Pontos Group.

In addition, the market saw the sale of a significant property portfolio by Ylva to Keva for approximately EUR 188 million, as well as a large Nordic transaction in which Public Property Invest acquired a substantial portfolio of public-use properties from SBB.

Overall, the increase in the number of transactions provides an even clearer indication of market recovery than volume figures alone. More than 210 transactions were completed during the year, with 63 transactions recorded in Q4—the highest quarterly count in 13 quarters. The return of large international investors, combined with renewed confidence and the ability to execute sizeable transactions, underpins a constructive market outlook. At the same time, investors remain selective, focusing on assets with strong fundamentals, resilient cash flow, and clear long-term investment rationale.

International capital supports market liquidity

International capital played a pivotal role in supporting liquidity in the Finnish real estate market in 2025. With domestic open-ended funds and pension investors remaining largely on the sidelines, foreign investors deployed approximately EUR 2.4 billion into the market, accounting for more than half of total transaction volume. Both returning and new investors were active, originating from across the Nordics, continental Europe, and the United States.

Investor confidence in European real estate has strengthened, and Finland has consolidated its position within the target allocation of international investors. Globally, real estate fundraising increased in 2025, with capital flows clearly extending to the Nordic region. The area’s stable political environment, predictable regulatory framework, and favourable long-term demographic and urbanisation trends continue to support investor interest.

Domestic institutional investor activity in Finland has remained limited. Pension investors have adopted a cautious stance, partly due to the ongoing pension reform, while redemptions have constrained activity among special investment funds. However, signs of stabilisation are emerging, with OP announcing the reopening of redemptions in its real estate funds—supporting expectations of a gradual return of domestic capital to the market.

Social infrastructure and retail in focus

Investment activity in 2025 was concentrated primarily in social infrastructure and retail assets. Residential transaction volumes recovered notably, although the number of individual transactions remained relatively low. Logistics investment volume remained subdued overall, but light industrial properties traded actively. The office market continues to await a broader turning point, while the hotel sector reactivated strongly following several subdued years.

Long lease terms, predictable cash flows, demographic trends, and urbanisation continue to support residential assets, logistics, and selected sub-segments within social infrastructure and retail. While the office market has yet to see a clear inflection point, pricing has become more attractive following yield expansion, and prime assets continue to demonstrate resilience in the leasing market.

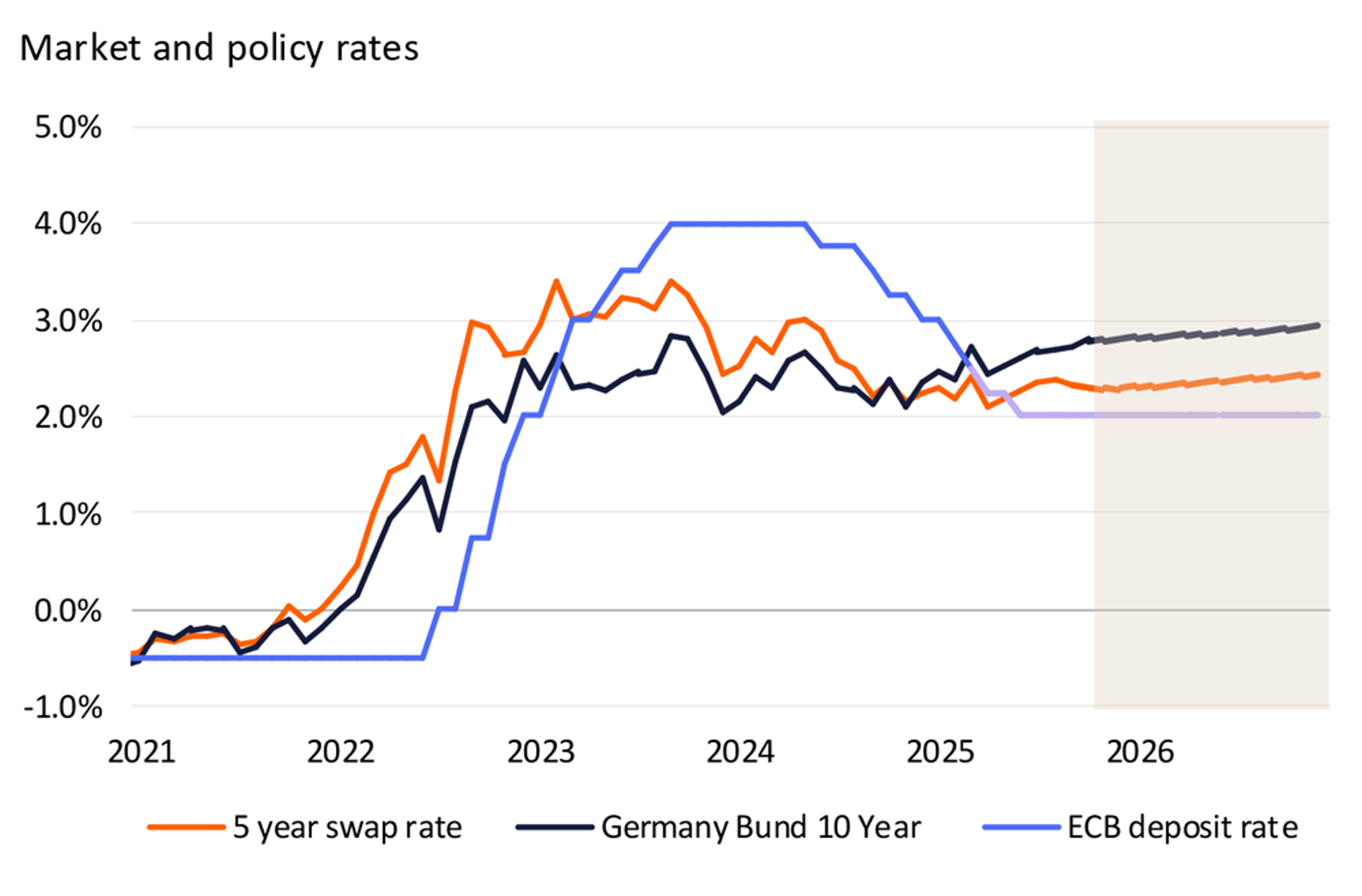

Interest rates remain relatively stable

The European Central Bank has maintained its policy rate at 2% since June 2025, and eurozone inflation is expected to remain close to target. Markets largely view the monetary easing cycle as complete, with interest rates expected to remain broadly stable in the near term. The increase in five-year EUR swap rates, together with Germany’s fiscal stimulus, supports the view that eurozone rates are more likely to trend modestly upwards rather than decline further.

Banks across the eurozone remain willing to finance real estate, particularly high-quality assets, with a continued focus on residential and logistics properties. Margins on prime assets have tightened due to competition, including across the Nordic region, and the overall lending outlook remains stable. At the same time, lenders maintain a cautious credit stance, emphasising sustainable cash flow and conservative leverage levels.

Finland’s economy is expected to grow modestly in 2026–2027. Elevated unemployment and weak consumer confidence continue to constrain a stronger recovery, although gradual improvement is anticipated, providing support across property sectors. Uncertainty related to US trade policy may still weigh on investor risk appetite and delay decision-making in certain segments.

Prime yields edge lower

Prime yields declined modestly on average during 2025. Strengthening demand was focused particularly on high-quality residential, logistics, social infrastructure, and grocery-anchored retail assets, where yield compression was observed. Newsec expects prime yields across core segments to continue to edge down modestly in the near term as investor demand strengthens.

In our base-case scenario, however, the scope for further yield compression in prime residential assets is limited. Long-term interest rates are expected to remain stable or increase slightly, narrowing the risk premium. In particular, the projected gradual increase in the eurozone risk-free rate—represented by the German 10-year government bond—creates mild upward pressure on prime residential yields over the medium term.

Outlook

Developments in 2025 provide a clearly positive starting point for 2026. Transaction activity is continuing to recover, pricing has largely stabilised, and international capital is supporting market liquidity. The next phase of the cycle will depend primarily on the stability of the financing environment and the gradual re-engagement of domestic investors.

Finland’s economic outlook remains subdued, but uncertainty has eased. With the exception of the United States, overall predictability has improved, supporting investment decision-making. In a Nordic comparison, Finland has lagged other markets in the cycle, but from a risk-adjusted return perspective—and given lower competition relative to Sweden and Denmark—the market presents an increasingly attractive allocation target for investors.

Transaction volumes and deal counts remain below long-term averages, but Newsec expects these levels to be reached during the course of 2026. Our forecast model indicates approximately 20% growth in transaction volume, implying total Finnish real estate transaction volume of around EUR 5.5 billion in 2026.

The reports below provide more detailed segment-specific analysis of market developments during the final quarter of the year.

Newsec Industrial and Logistics Q4/2025

Newsec Public Properties Q4/2025

Further information:

Valtteri Vuorio

Head of Research,

Newsec Advisory in Finland

valtteri.vuorio@newsec.fi

+358 40 705 3093

The downloadable market reports provide basic information on the real estate market in the previous quarter. More detailed information by segment and submarket is available in Newsec's on-demand market reports. Newsec provides the most comprehensive information on the residential, office, and logistics market. To find out more, contact markkinakatsaukset@newsec.fi.

Yksityiskohdat

Julkaisupäivä

260211

Muoto

Kieli

English