Newsec Property Outlook Finland spring 2025 -

The Finnish real estate investment market is entering a recovery cycle after challenging years. Although transaction volume reached only EUR 2.2 billion last year and international investor activity remained below normal, the market now shows many positive signals.

Newsec Property Outlook Finland provides a comprehensive overview of the 2025 Finnish real estate investment market outlook.

Key Highlights from the Report:

- Donald Trump’s policies will reshape international economic relations in 2025.

- Real estate investment activity improved across the Nordics and Europe last year, but Finland has yet to follow suit.

- There is significant potential for a market rebound in Finland, particularly if international investor interest increases.

- Newsec expects Finland’s transaction volume to grow by approximately 40% compared to last year. Interest rate cuts and economic recovery gradually strengthen the foundation for positive market development.

- Newsec sees potential in prime yield compression as the market recovers, demand strengthens, and the ECB’s policy rate declines. However, a stable market rate outlook keeps this outlook moderate.

Interest rate cuts initiated by the European Central Bank from the summer of 2024 onwards have generated positive expectations for the real estate investment market. The ECB’s deposit rate is anticipated to fall to around 2% by summer 2025, supporting the market recovery.

"There are many positive signals in the market. Transaction volume growth will be steady and assured." Esa Pentikäinen, Head of Capital Markets

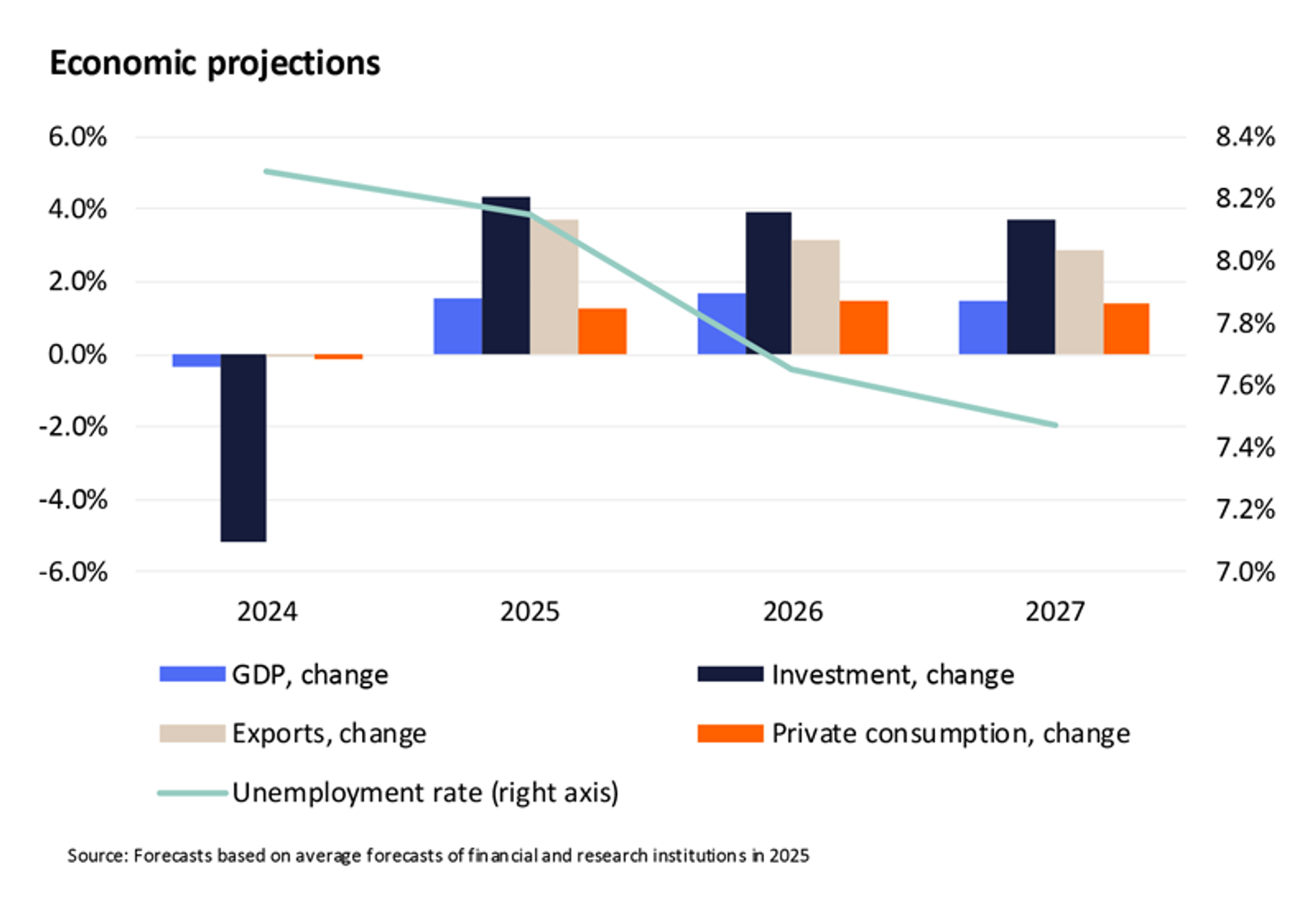

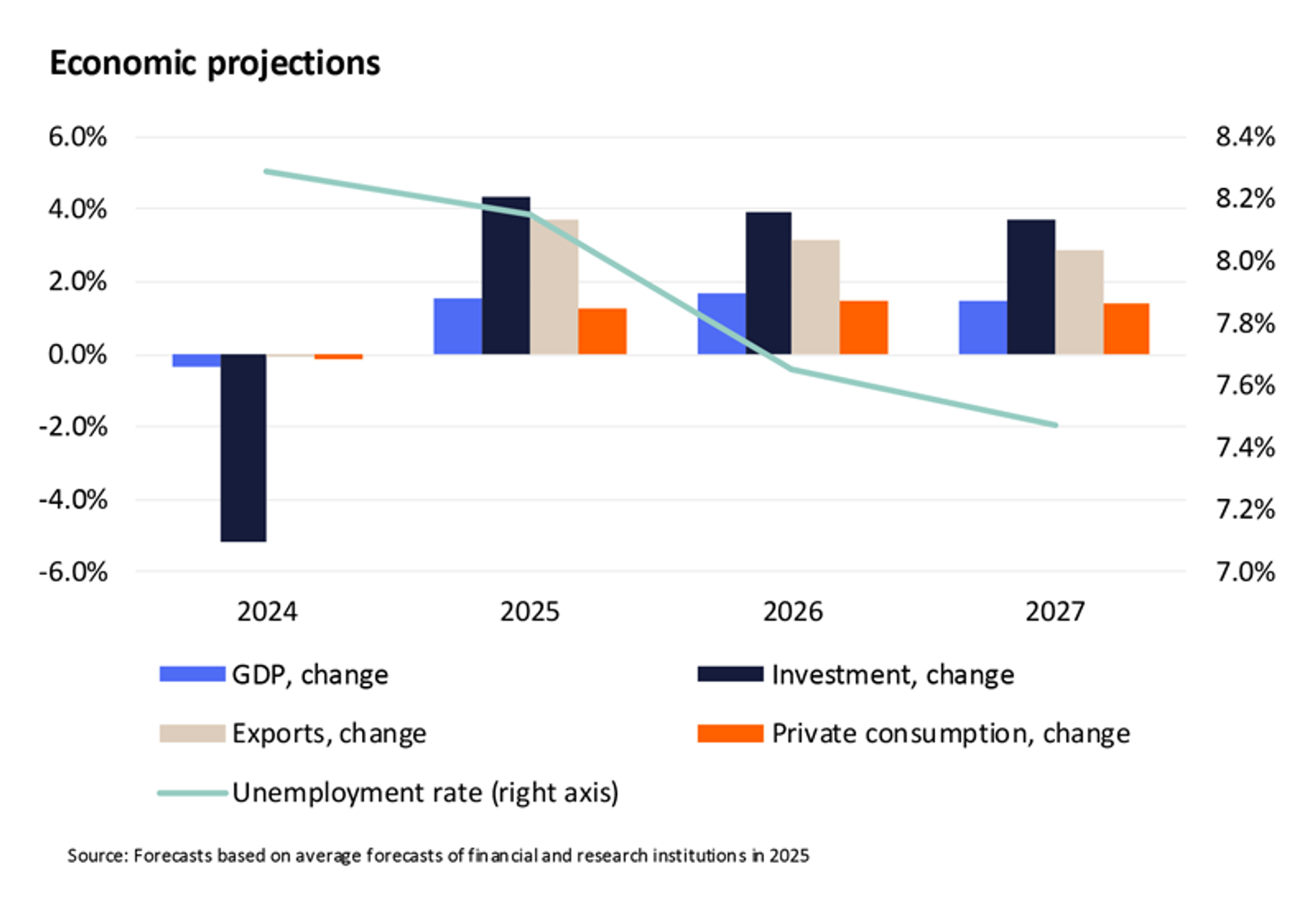

With declining interest rates and strengthening economic fundamentals, investor interest in Finland is expected to grow gradually, although geopolitical risks continue to create uncertainty. Finland’s economy has grown for four consecutive quarters, and 2025 growth is projected to surpass the Eurozone average. Positive economic news will likely further strengthen investor and consumer confidence in the market.

The residential sector remains the market’s leading segment in 2025. While some oversupply is still evident in the Helsinki Metropolitan Area, occupancy rates have improved significantly, drawing investors back into the market. Demand for residential assets is expected to remain strong, particularly in Helsinki and Tampere.

"Newer rental apartments are finally reaching better occupancy as oversupply has eased." Sanna Lehikoinen, Head of Residential Properties Management

The office market faces challenges, but tenant demand for modern Grade A assets in Helsinki CBD remains strong. In addition to location, the focus is increasingly on high-quality, customer-centric office space. While investment opportunities exist in the Helsinki office market, the recovery timing in transaction activity remains uncertain.

"In offices, the phrase 'the customer is king' holds truer now than ever." Adriana Ståhlberg-Bruun, Head of Tenant Experience

Investor demand for logistics properties remains strong, with the segment highly favored by investors across Europe and Finland. In the logistics sector, particularly in the Helsinki region, the shortage of modern assets continues to support investment demand. However, leasing has become more challenging, increasing competition for high-quality tenants.

The social infrastructure segment is also showing signs of recovery, especially in healthcare and elderly care, where population aging is driving demand. As wellbeing services counties clarify their space requirements, new investment opportunities are expected to emerge towards the end of the year.

In 2025, we expect a gradual recovery in the real estate investment market and increasing transaction volumes. As liquidity improves, attractive opportunities will emerge for investors ready to capitalize on changing market conditions.

Click the "Lataa" button at the top of this page to download the full Newsec Property Outlook Finland report.

For further information:

Valtteri Vuorio

Head of Research

valtteri.vuorio@newsec.fi

+358 40 705 3093

Yksityiskohdat

Julkaisupäivä

250403

Muoto

Sivut

Kieli

English