Finland Real Estate Market Q1 2025 -

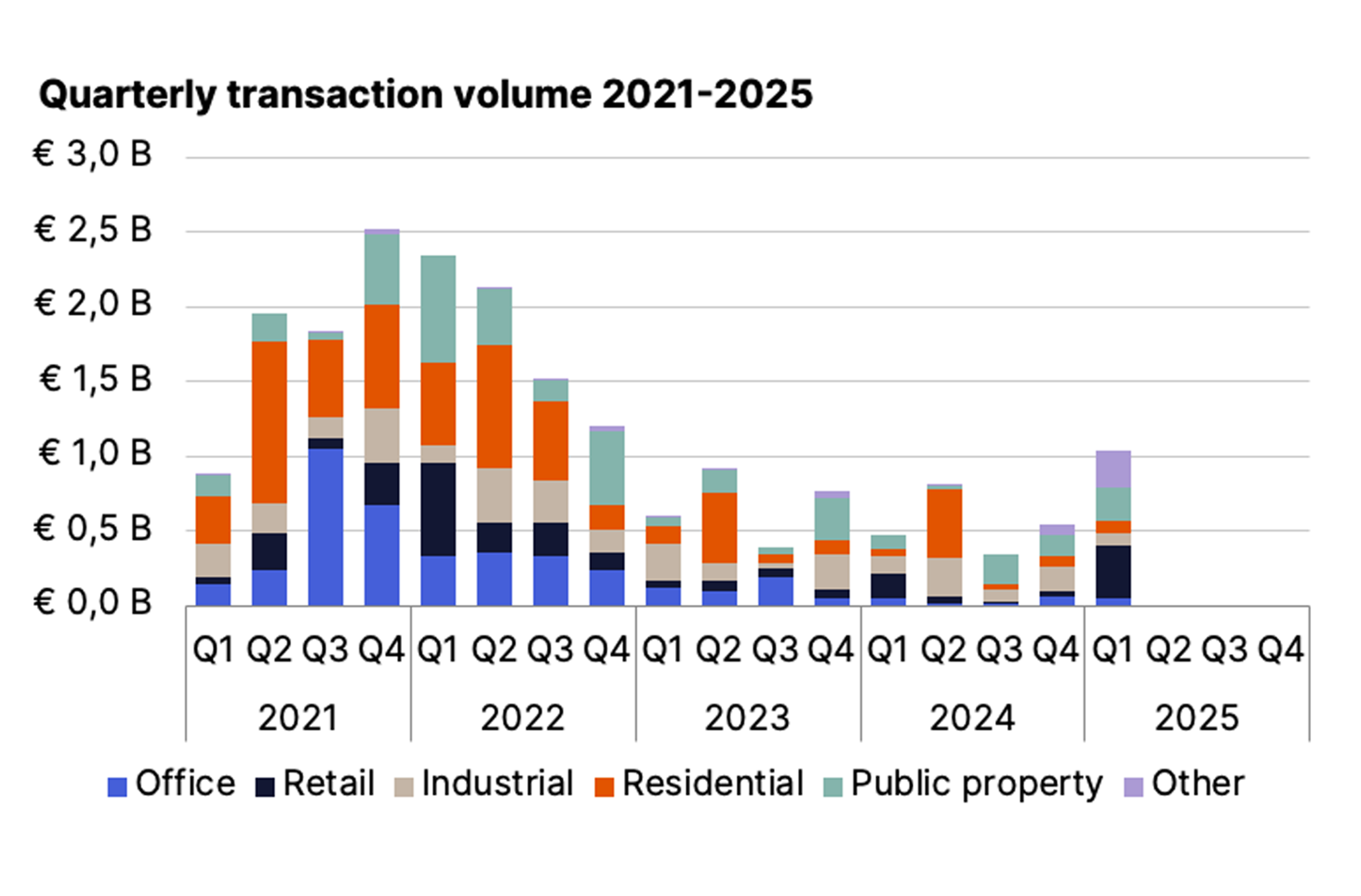

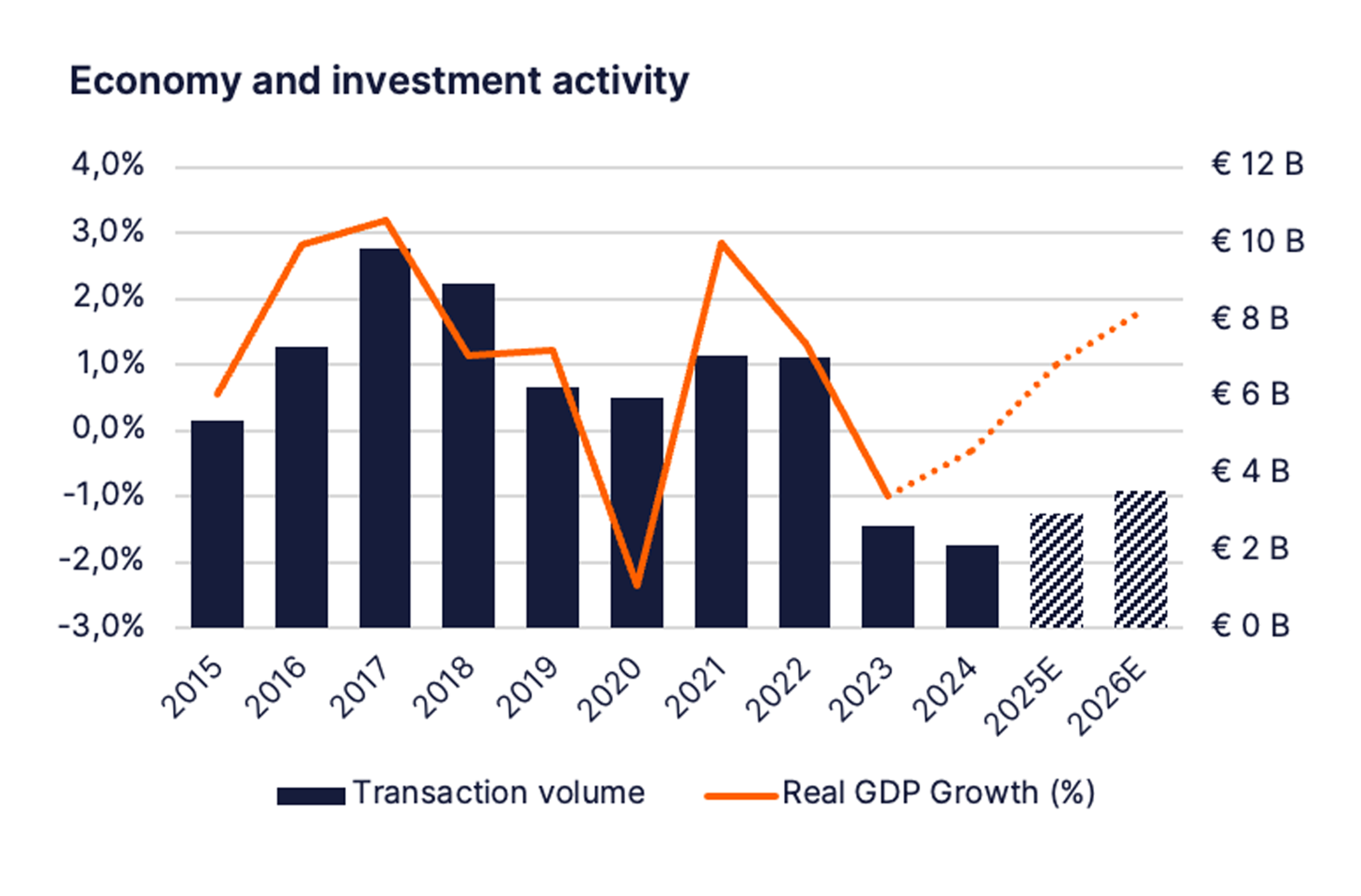

Recovery underway: In Q1 2025, Finland's transaction volume reached 1.0 billion euros, a 113% increase year-on-year or a 7% increase in trailing twelve-month volume. All this suggests that the investment market cycle has started to shift. The real estate investment markets in the Nordics and Europe showed increased activity in 2024, and Finland is expected to align with this trend during 2025.

Heightened activity

In the first quarter of 2025, transaction volume in Finland totaled approximately €1.0 billion. Retail assets, public properties, and hotels collectively accounted for 70% of the total volume. Overall, Q1 transaction activity remained broadly in line with first-quarter long-term averages.

Market sentiment in Finland continues to be cautious. Due to the macro environment, the development of the investment market is difficult to predict. On a positive note, we witness heightened activity from both domestic and international investors. After a cycle of repricing, Finland offers excellent opportunities for investors. There has been a rise in sales processes, and we expect transaction volume to increase from the previous year.

Retail represented 34% of the total volume for Q1 2025, amounting to €356 million. Public properties accounted for 22%, followed by hotels at 15%.

Key transactions in the first quarter of 2025 include K-kauppiasliitto’s acquisition of a one-third stake in Mercada Ltd, a grocery and shopping center company, from AMF Tjänstepension AB. Additionally, Swiss Life and Trevian Asset Management purchased the Skanssi shopping center from CBRE Global Investors.

Unpredictability grows in the transaction market

Early in 2025, the Finnish real estate market sentiment was cautiously optimistic. Investor appetite was gradually recovering, supported by expectations of economic improvement driven by stronger consumer confidence and a rebound in exports. However, the evolving landscape of U.S. tariff policies has introduced new uncertainties, clouding the outlook and injecting volatility into the transaction market.

The market’s path to stability will depend on several factors: the resolution of global trade tensions, the absorption of excess housing supply, particularly in the Helsinki region, and the continuation of broad-based economic growth. In this context, many investors will likely adopt a more cautious approach, carefully tracking macroeconomic signals and sector-specific developments. This caution may temper transaction activity in the short term.

Nevertheless, there are signs of resilience. Transaction volumes in Finland are projected to rise in 2025, despite the uncertain environment. We maintain our year-end forecast of approximately €3 billion in total volume, a notable 40% increase from 2024. Also, despite the dampening outlook, the Finnish economy is still predicted to grow in 2025. In addition, Germany has announced a reform of its debt brake and enacted a sizeable fiscal stimulus, which may positively affect the export-driven Finnish economy.

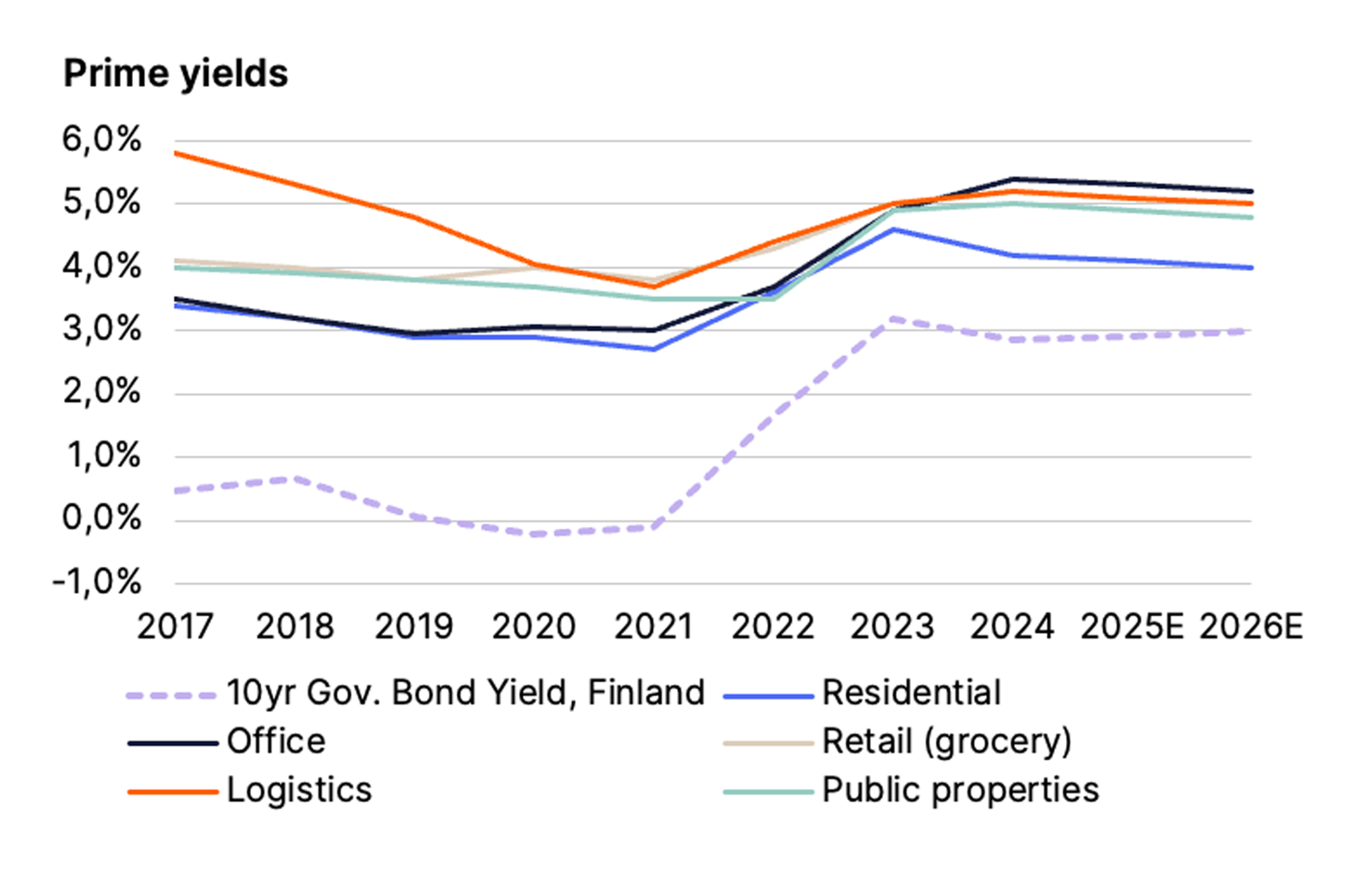

Yields to remain stable

Yields have now broadly aligned with financing costs, and our base case scenario assumes continued stability in prime yields following the recent market correction. In 2025, a slight compression in prime yields may be observed for the most sought-after assets; however, with limited downward pressure on the risk-free rate, further yield compression appears limited.

As of Q1, prime residential yields stood at 4.2%, public properties at 5.0%, and both grocery-anchored retail and logistics assets at 5.2%. Prime office yields remained at 5.4%. Market polarization and weaker demand outside the prime segment contribute to upward yield pressure, widening the gap between prime and non-prime assets.

The attached reports provide more detailed information on developments by segment for the first quarter of the year.

Newsec Industrial and Logistics Q1/2025

Newsec Public Properties Q1/2025

More information:

Valtteri Vuorio

Head of Research,

Newsec Advisory in Finland

valtteri.vuorio@newsec.fi

+358 40 705 3093

The downloadable market reports provide basic information on the real estate market in the previous quarter. More detailed information by segment and submarket is available in Newsec's on-demand market reports. Newsec provides the most comprehensive information on the residential, office, and logistics market. To find out more, contact markkinakatsaukset@newsec.fi.

Yksityiskohdat

Julkaisupäivä

250429

Muoto