Finland Real Estate Market Q2 2025 -

Momentum in the Finnish property transaction market strengthened in Q2 2025, with total volumes reaching €1.0 billion — up 24% year on year and 26% on a trailing twelve month basis. The investment market cycle continues to shift in a more positive direction, supported by improving sentiment and broader recovery signals. Following the pickup in activity across the Nordic and wider European markets in 2024, Finland is expected to further align with this upward trend throughout 2025. Tariff policy and geopolitical risks continue to reshape market dynamics, prompting investors to adopt a more risk-averse stance. Nonetheless, the Finnish real estate market is now on a firmer footing than at any point in the past two years.

Market Highlights – Q2 2025

- Transaction volumes rebound: Total investment reached €1.0 billion in Q2; H1 (incl. July) activity of €2.5 billion has already exceeded 2024’s full-year total.

- International capital returns: Swedish investors re‑entered strongly, with volumes surpassing the previous two years’ totals.

- Landmark deals closed: Kojamo’s €242 million residential portfolio sale to Apollo-managed funds and Avant Capital Partners marked the quarter’s mega‑deal, alongside key acquisitions in retail and life sciences.

Bolstered transaction activity

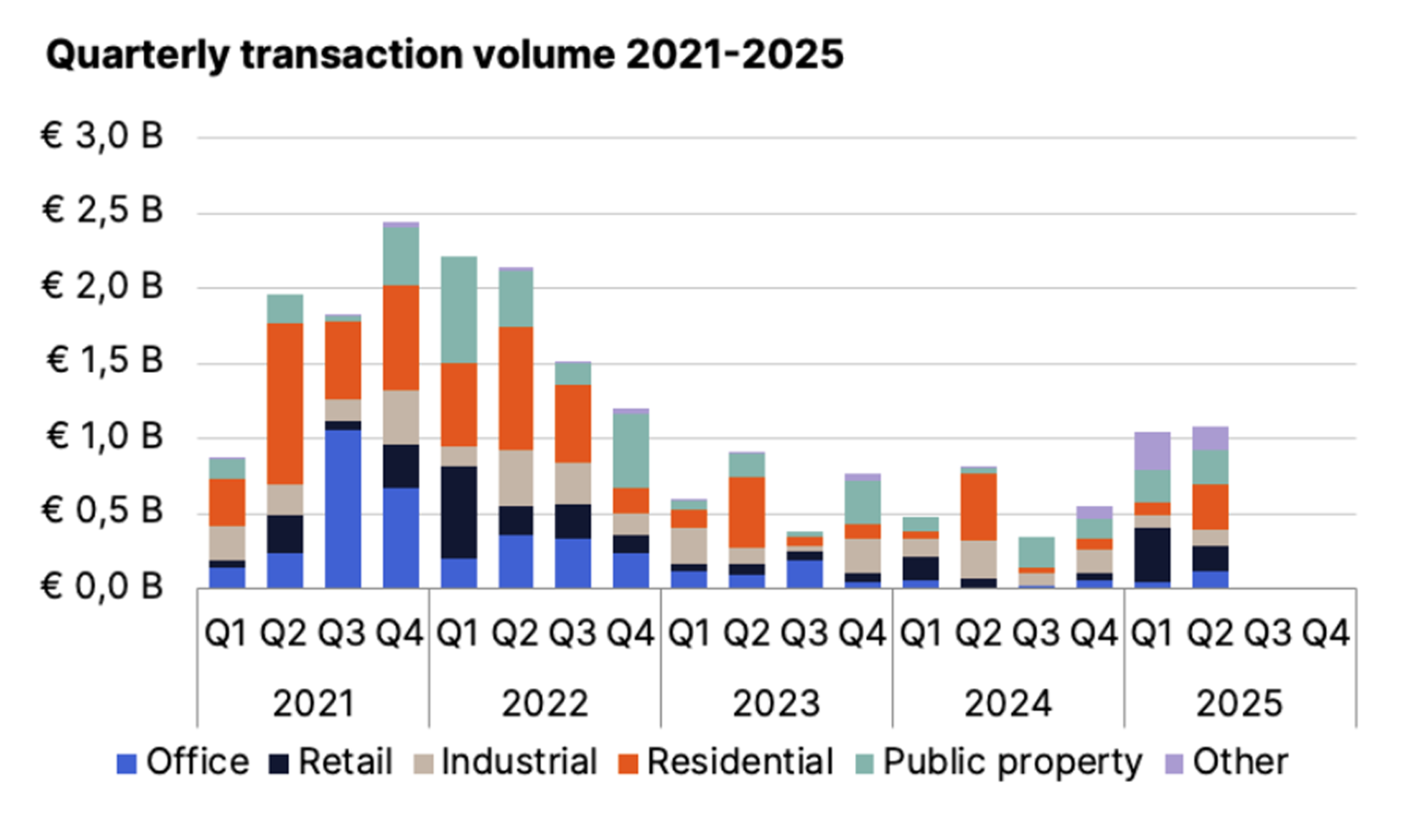

In Q2 2025, transaction volumes in Finland totaled approximately €1.0 billion. The residential sector captured the largest share, with €303 million in deal volume, while the Industrial & Logistics segment recorded the highest number of transactions at 15.

Including July, total investment activity for H1 2025 has already reached €2.5 billion — surpassing the full-year total of 2024 and signaling a clear recovery in the Finnish property market.

International capital has become increasingly active, led by Swedish investors whose volumes already exceed the full-year totals of the past two years. Following a repricing cycle, Finland now presents highly attractive opportunities for both domestic and cross-border investors.

Key Q2 transactions included a landmark €242 million portfolio deal in which Kojamo divested 44 rental housing properties across eight municipalities to Apollo-managed funds and Avant Capital Partners. Other notable deals were Turun Osuuskauppa’s acquisition of a 50% stake in Shopping Centre Mylly (Turku region) from SOK, and Public Property Investment’s €79 million purchase of a life science development in Espoo from HGR Property Partners.

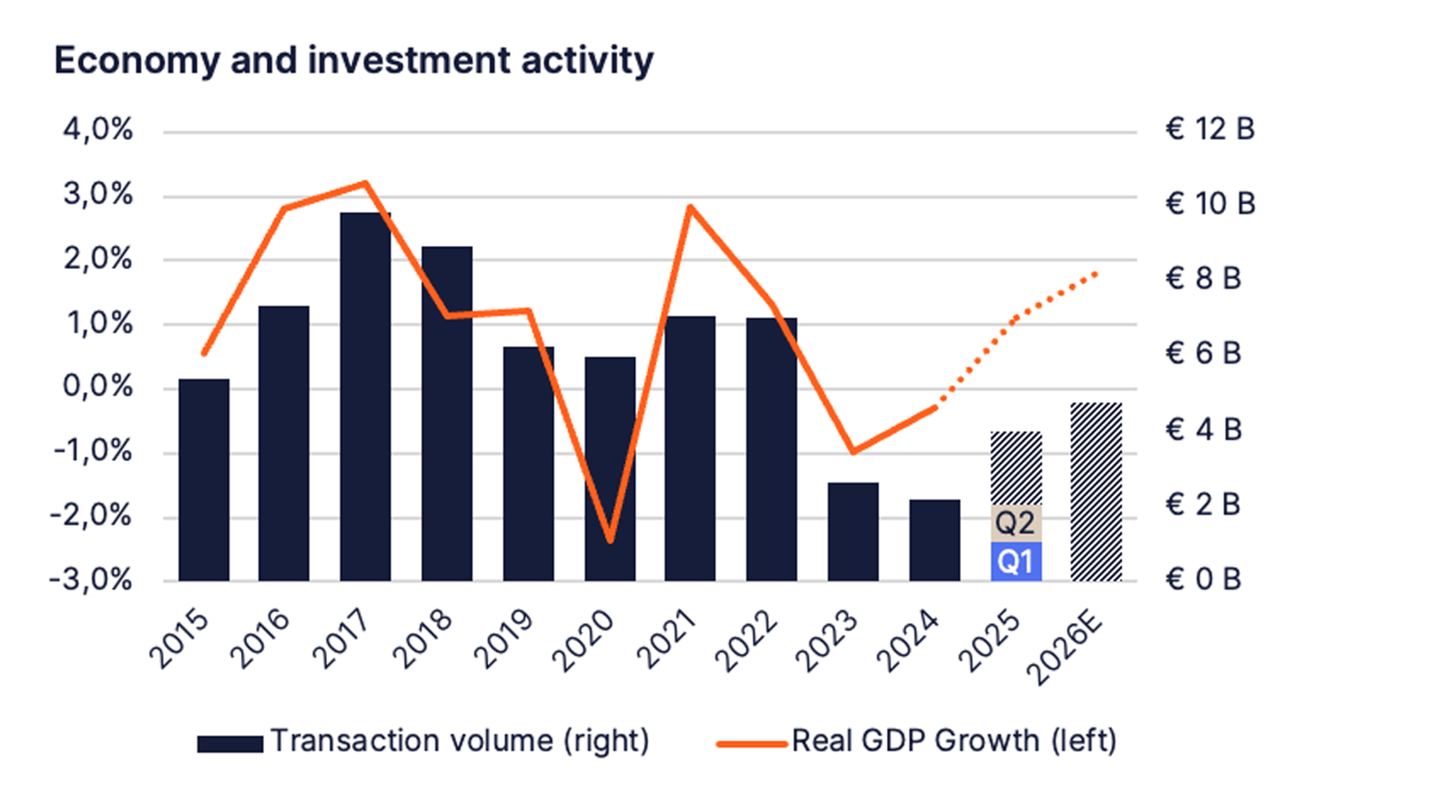

Towards modest economic growth

The Finnish economy remained on a modest growth path during the first half of 2025. While global trade policy uncertainty has weighed on sentiment, early signs of recovery have emerged, particularly in export performance and the labour market. The newly agreed U.S.–EU trade deal, should improve investor sentiment by reducing global trade uncertainty.

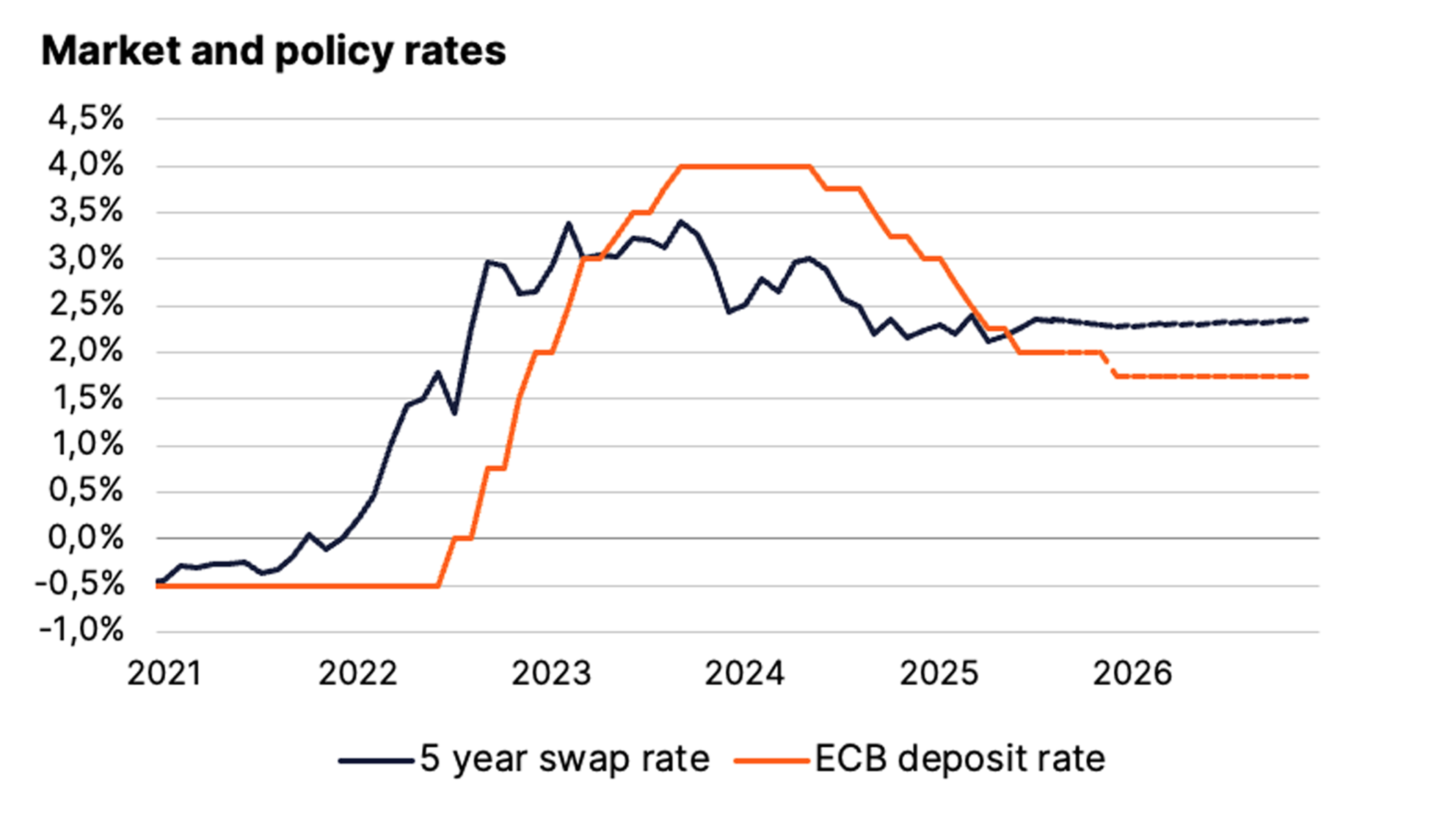

Inflation continues to ease across the euro area, and the ECB’s rate cuts are gradually improving financing conditions. The deposit rate currently stands at 2.0%, with markets pricing in an additional 25 bps cut in December — potentially bringing the rate to around 1.75% by year-end. The ECB maintains a data-dependent, meeting-by-meeting approach, with any further easing contingent on incoming inflation, wage, and growth developments.

Consumer confidence remains subdued, and private consumption is still restrained. However, unemployment has begun to decline, and real income growth is expected to improve in the latter half of the year. Although construction activity remains weak, a gradual rebound in overall investment activity is anticipated as macro conditions stabilise.

Finland’s transaction outlook strengthens

Transaction volumes in Finland are projected to rise in 2025 despite a still cautious macro environment. We revise our full-year forecast to approximately €4 billion in total transaction volume (previously €3 billion) — representing a significant 80% increase compared to 2024. This outlook is supported by a gradually strengthening economic backdrop, easing interest rates, renewed cross-border capital inflows, and a visible pipeline of upcoming deals.

That said, lingering market uncertainty — particularly around global trade dynamics and investor risk appetite — may still introduce volatility and delay decision-making in certain segments. Nonetheless, the overall trajectory points toward a more active and stabilised investment market by year-end.

Yields to remain stable

Following an uptick in Q1, Eurozone swap rates declined in Q2, returning to levels last seen in Q4 2024. The 5-year EURIBOR swap rate fell by approximately 20 basis points, driven by easing trade tensions—helped by recent trade agreements—and weaker-than-expected macroeconomic data.

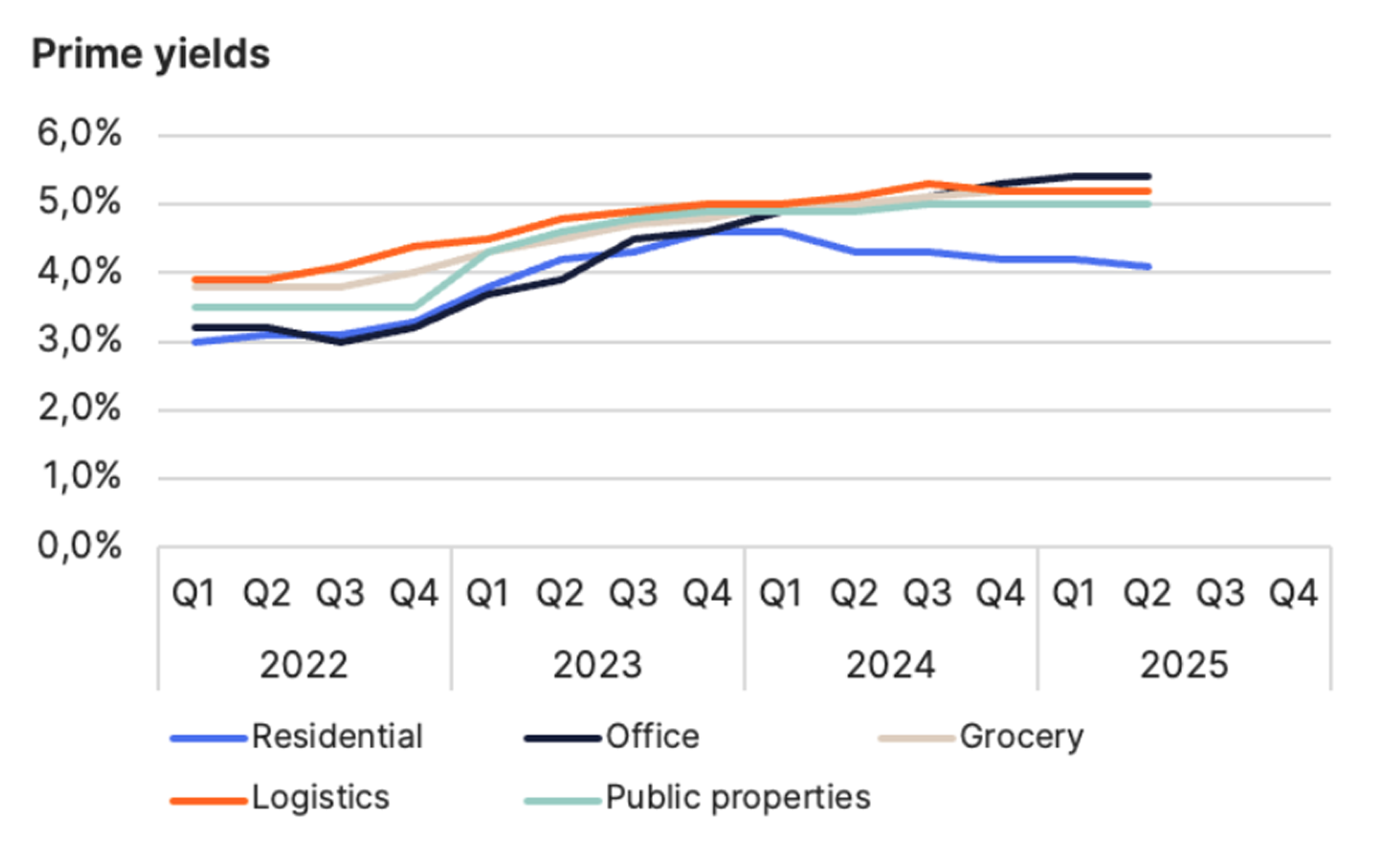

Prime property yields have averaged 5.3% over the past five quarters, with a slight compression to 5.2% in Q2 2025, driven by a 10 basis point decline in residential prime yields to 4.1% quarter-on-quarter. Other core segments remained unchanged from the previous quarter: public properties at 5.0%, grocery-anchored retail and logistics both at 5.2%, and prime office yields at 5.4%.

Yields have broadly realigned with financing costs, and our base case assumes continued near-term stability in prime yields. Further compression in residential yields may occur in 2025, while yield tightening across other segments is expected to begin gradually from 2026 onward.

The attached reports provide more detailed information on developments by segment for the first quarter of the year.

Newsec Industrial and Logistics Q2/2025

Newsec Public Properties Q2/2025

More information:

Valtteri Vuorio

Head of Research,

Newsec Advisory in Finland

valtteri.vuorio@newsec.fi

+358 40 705 3093

The downloadable market reports provide basic information on the real estate market in the previous quarter. More detailed information by segment and submarket is available in Newsec's on-demand market reports. Newsec provides the most comprehensive information on the residential, office, and logistics market. To find out more, contact markkinakatsaukset@newsec.fi.

Yksityiskohdat

Julkaisupäivä

250811

Muoto