Finland Real Estate Market Q2 2024 -

Close to the bottom: The Finnish real estate market turnaround is within reach.

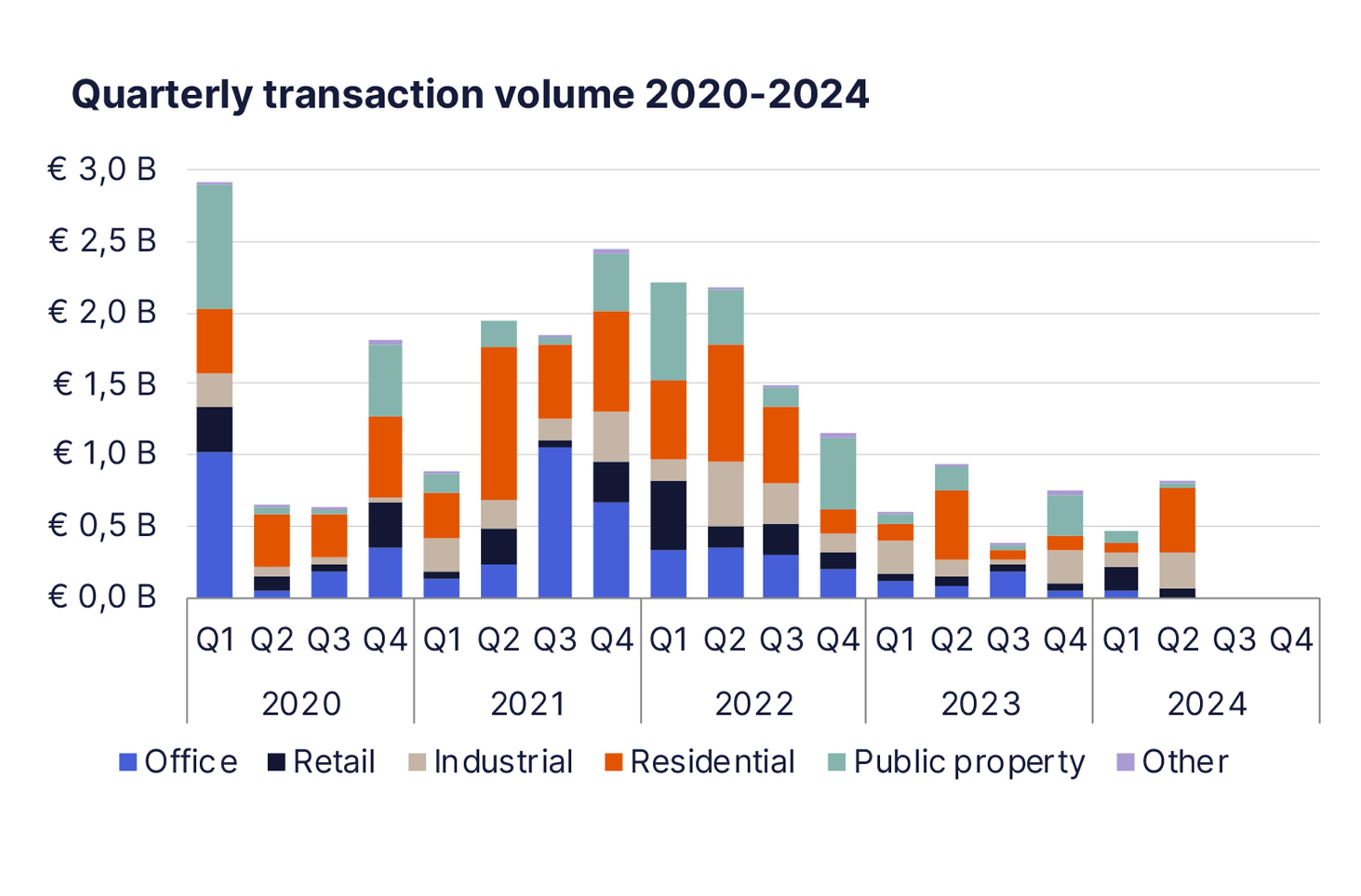

A slow and steady recovery is underway, with signs indicating we are nearing the bottom. In Q2, €817 million worth of deals were transacted, a 72% increase from the previous quarter but a 12% decrease from the same period last year. Despite the annual decline, the slowdown suggests a positive outlook for real estate transactions in Finland.

H1 2024 saw €1.3 billion in activity, significantly below the €3.0 billion 10-year average. However, the increase in Q2 investments indicates a slightly more optimistic sentiment. The Finnish real estate market appears to be bottoming out in terms of trailing 12-month volume.

Residential in demand

In Q2, residential properties led all sectors with 55% of total volumes, followed by industrial and logistics at 32%, and retail at 7%. Residential demand has increased, attracting significant investments, including from international investors. The number of residential deals this quarter was the highest in two years.

International investors made up 37% of the total investment volume in Q2, and 68% of transactions occurring in the Helsinki Metropolitan Area. Investors are selective, focusing on assets that offer the highest returns through profit growth and strong fundamentals. As a result, residential and logistics are the top choices. Retail demand is concentrated on grocery-anchored and big box premises, resulting in modest transaction volumes. Public properties transactions have so far this year remained relatively subdued. Office investments remain cautious and limited.

Key transactions in Q2 2024 include Blackstone’s €135 million purchase of a light industrial portfolio from NREP and Slättö’s acquisition of nearly 800 apartments for €130 million.

Yields to remain stable

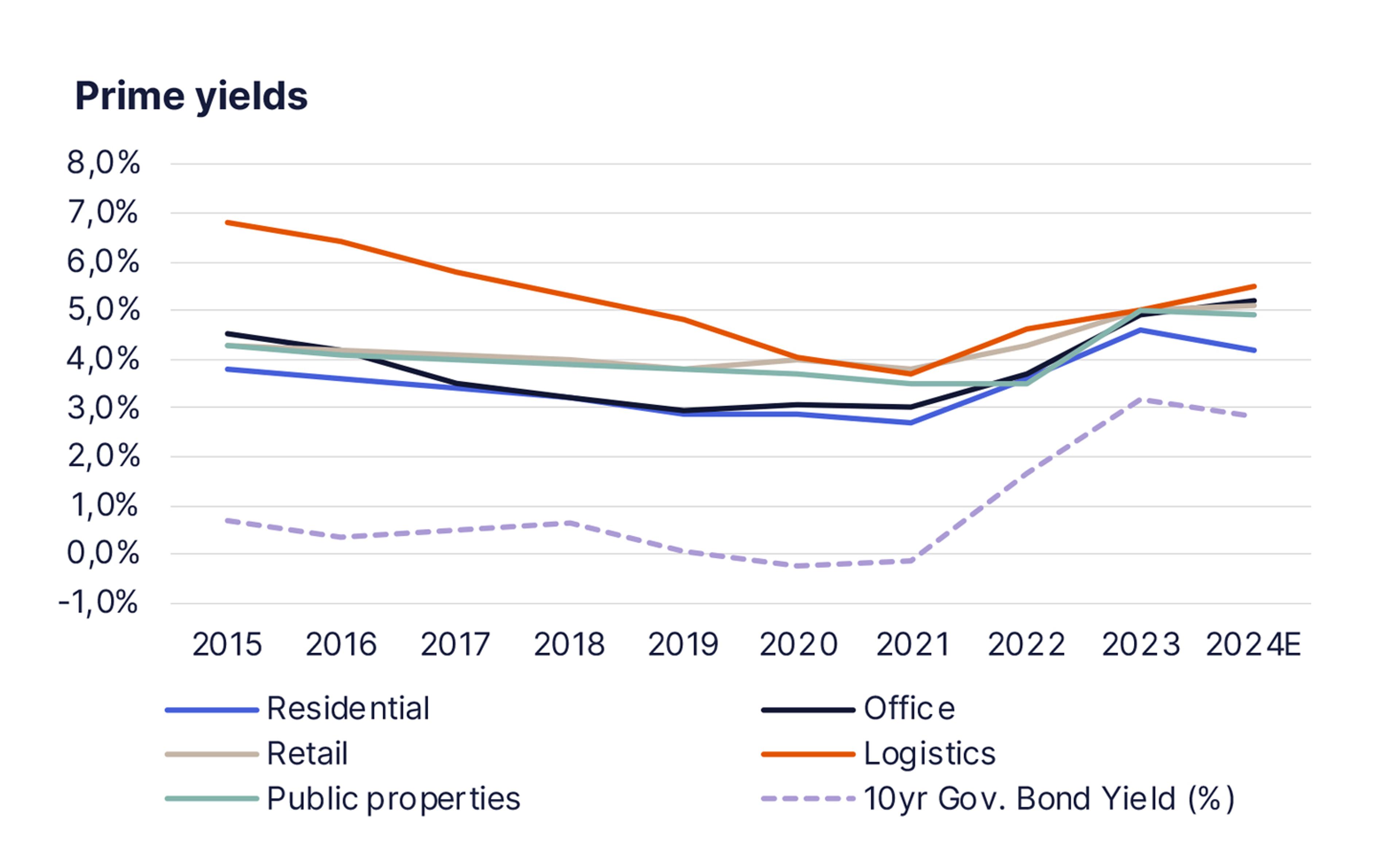

Yield stabilization is expected to begin in most segments by Q3 2024. In Q2, all prime yields, except residential, increased by 10-30 bps, while residential prime yield decreased by 30 bps. We anticipate stable yields across most sectors with minimal movement in the medium term.

In June, the Euro area saw its first interest rate cuts, with the deposit rate lowered by 0.25pp to 3.75%. The European Central Bank remains cautiously optimistic about controlling inflation, adopting a data-dependent, meeting-by-meeting approach to setting rates. Economists polled in July expect the deposit rate to reach 3.25% by year-end.

Currently, the risk premium between the risk-free rate and prime real estate yield is widening, leading to a clearer pricing environment in the market.

Outlook for remainder of the year

For 2024, we anticipate a moderate rise in investment volumes compared to last year. With interest rates set to decrease, price expectations between buyers and sellers are aligning. This, along with ongoing motivated selling, will likely boost transaction numbers. Consequently, we expect investment volumes to continue growing throughout the year.

More detailed information on developments by segment for the second quarter of the year can be downloaded from the attached reports.

Newsec Industrial and Logistics Q2/2024

Newsec Public Properties Q2/2024

More information:

Valtteri Vuorio

Head of Research,

Newsec Advisory in Finland

valtteri.vuorio@newsec.fi

+358 40 705 3093

The downloadable market reports provide basic information on the real estate market in the previous quarter. More detailed information by segment and submarket is available in Newsec's on-demand market reports. Newsec provides the most comprehensive market information on the residential, office and logistics markets. For more information contact markkinakatsaukset@newsec.fi.

Yksityiskohdat

Julkaisupäivä

240807

Muoto

Kieli

English