Finland Real Estate Market Q4 2023 -

Activity in the Finnish real estate investment market remained exceptionally low in 2023. Much of the investment activity was characterized by the ever-evolving financing costs, and with that the repricing process. In turn, the transaction activity has suffered.

Repricing Kept Investments Low Over 2023

Activity in the Finnish real estate investment market remained exceptionally low in 2023. Much of the investment activity was characterized by the ever-evolving financing costs, and with that the repricing process. In turn, the transaction activity has suffered.

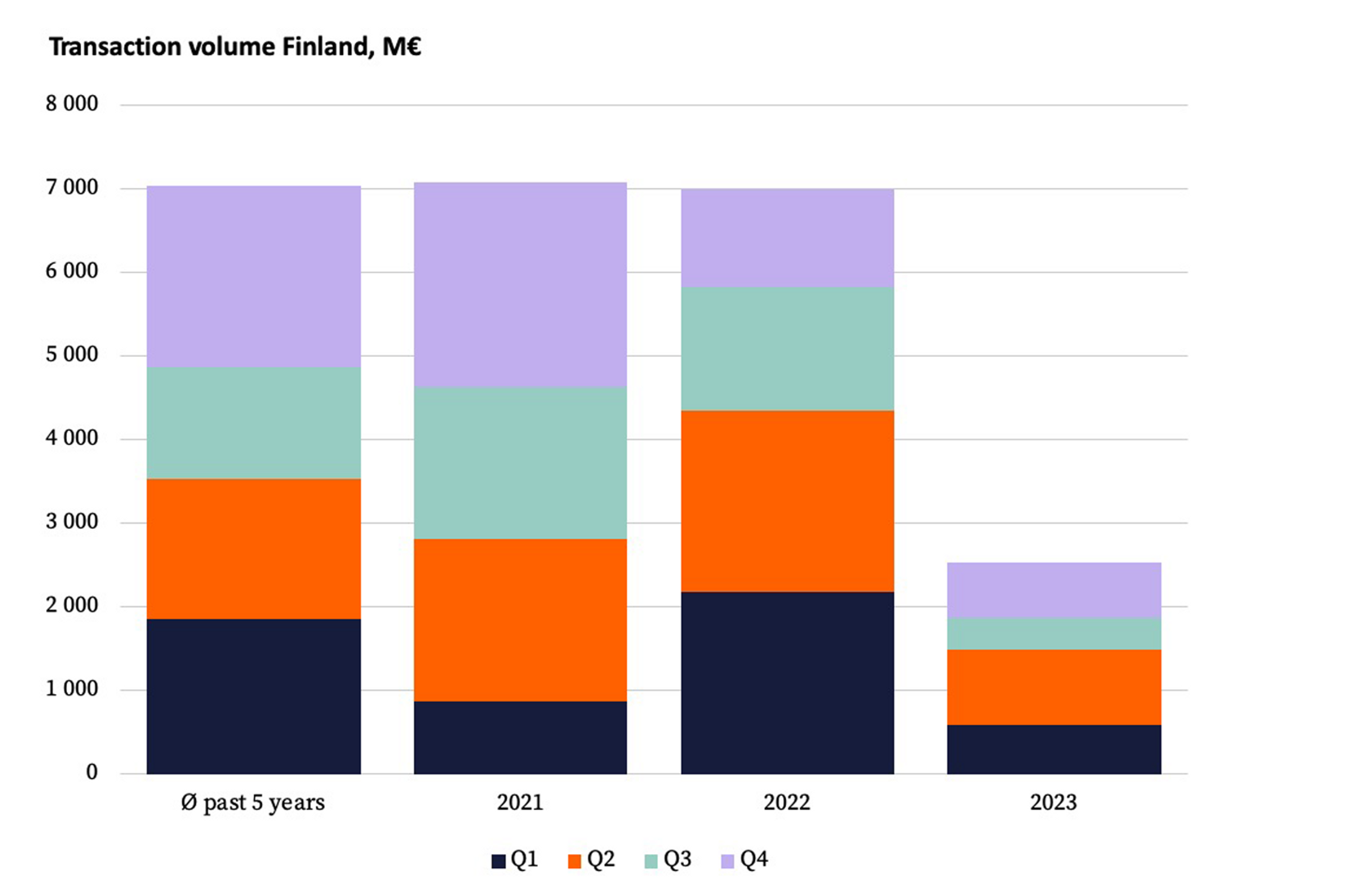

Newsec registered around 140 transactions for the full year, down by 35 percent compared to previous year. The real estate transaction volume in 2023 was EUR 2.6 billion (-63% YoY). Comparable volumes have last been seen in 2013. The average volume of 2005-2022 is EUR 5.1 billion.

International investors accounted for 58% of the total investment volume in 2023 (49% in 2022). Around 47% of the transactions took place in the Helsinki Metropolitan Area in 2023. The Turku and Tampere regions both accounted for 6% of total transaction volume over the same period.

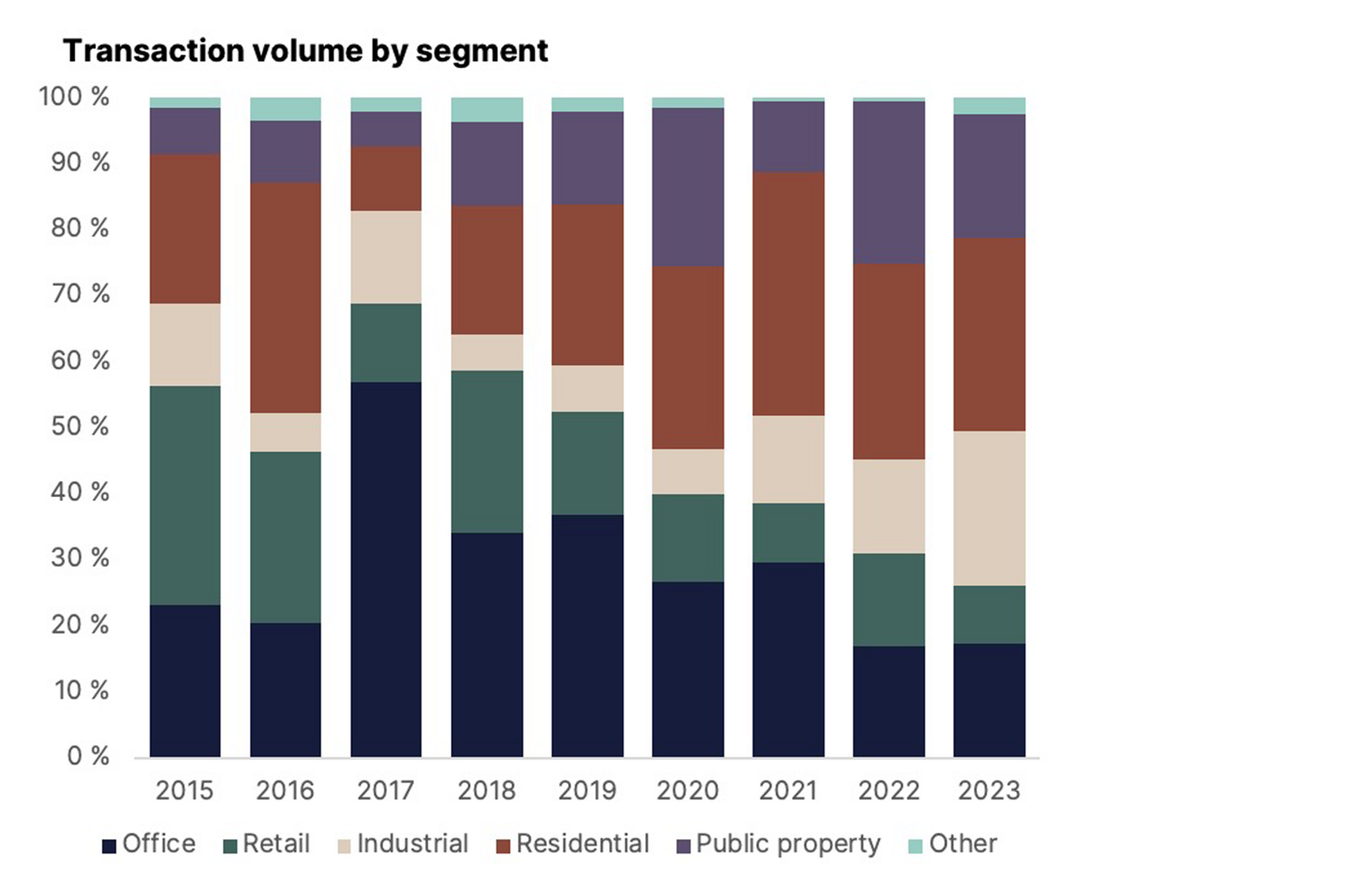

The largest segment in terms of transaction volume in 2023 was residential with EUR 758 million (-62% YoY), accounting for 29% of the total volume. Logistics full year volume was EUR 609 million (-39% YoY), public properties EUR 486 million (-72% YoY), offices EUR 453 million (-62% YoY), retail EUR 224 million (-77% YoY) and other segments EUR 66 million (+79% YoY).

The most significant transactions in 2023 have been Goldman Sachs purchase of a logistics portfolio from Macquarie Asset Management, KKR's purchase of a portfolio of over 1 200 apartments from Kruunuasunnot and NREP’s purchase of a 17 care assets portfolio with EUR 100 million from eQ.

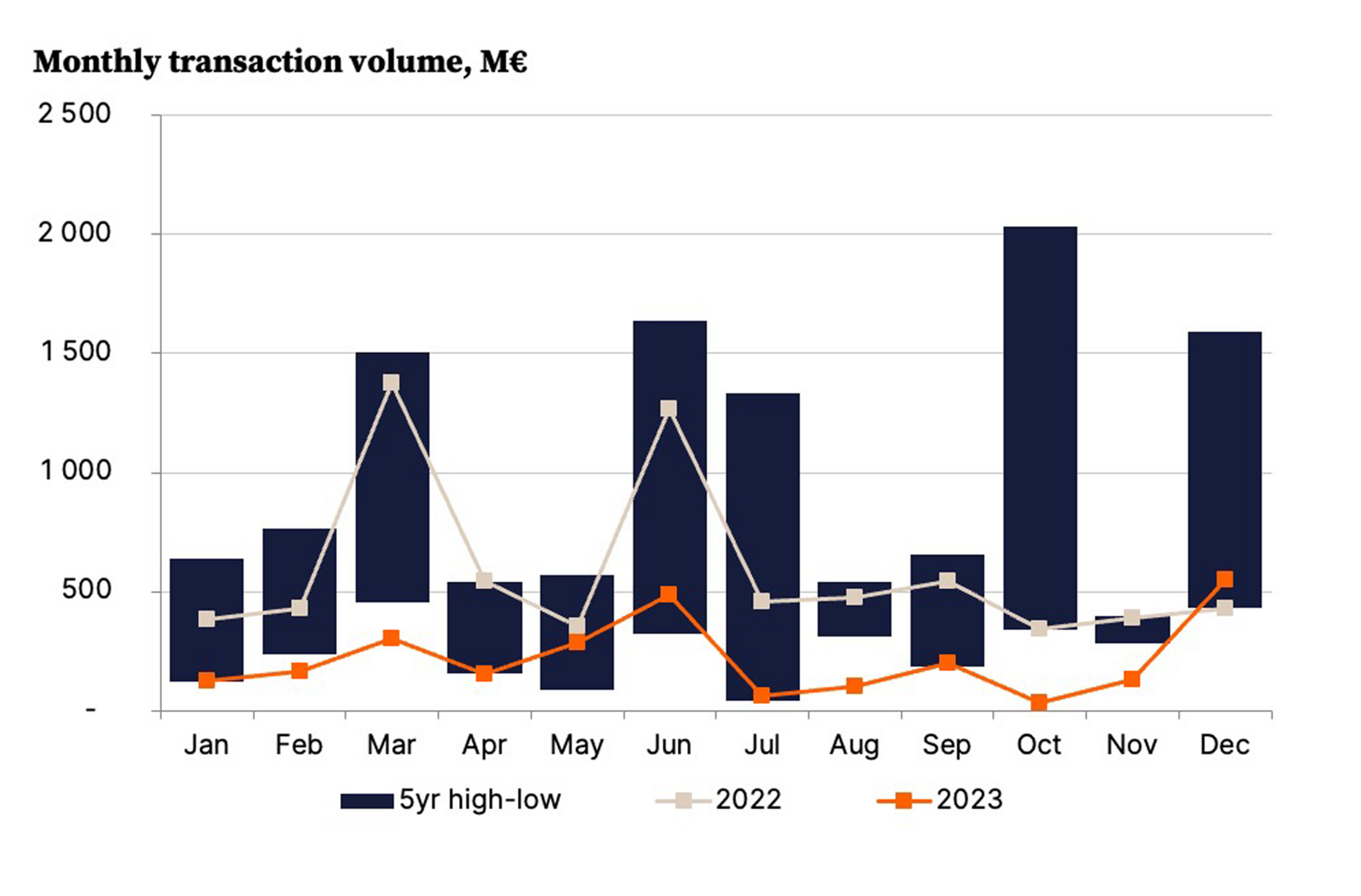

Of the full year, Q3 was the lowest in terms of transaction volume (EUR 383 million). The last quarter of the year saw more activity in the investment market with EUR 696 million, and December had the biggest monthly transaction volume in 2023 with EUR 550 million, also being the most active single month in the past 15 months.

Rising interest rates and higher risk premiums have led to increased costs for financing, which has resulted in higher yields. Yield decompression has continued for 6 quarters in a row starting from Q3/2022 and affecting all segments. Currently the risk premium shows signs of widening between the risk-free rate and prime real estate yield, and thus a clearer pricing environment is emerging in the market.

Faster-than-expected deceleration of inflation has accelerated expectations for European Central Bank interest rate cuts. ECB is set to cut rates when sure inflation is set for 2%. The consensus expects the ECB to start reducing rates in July. As the pace of transaction volume decline shows slowing, investment volumes may be close to bottoming out and outlook for 2024 is looking clearer.

More detailed information on developments by segment for the fourth quarter of the year can be downloaded from the attached reports.

Newsec Industrial & Logistics Q4/2023

Newsec Public Properties Q4/2023

The downloadable market reports provide basic information on the real estate market in the previous quarter. More detailed information by segment and submarket is available in Newsec's on-demand market reports. Newsec provides the most comprehensive market information on the residential, office and logistics markets. To find out more contact markkinakatsaukset@newsec.fi.

More information:

Valtteri Vuorio

Head of Research,

Newsec Advisory in Finland

valtteri.vuorio@newsec.fi

+358 40 705 3093

Yksityiskohdat

Julkaisupäivä

240208

Muoto

Kieli

English