Finland Real Estate Market Q4 2024 -

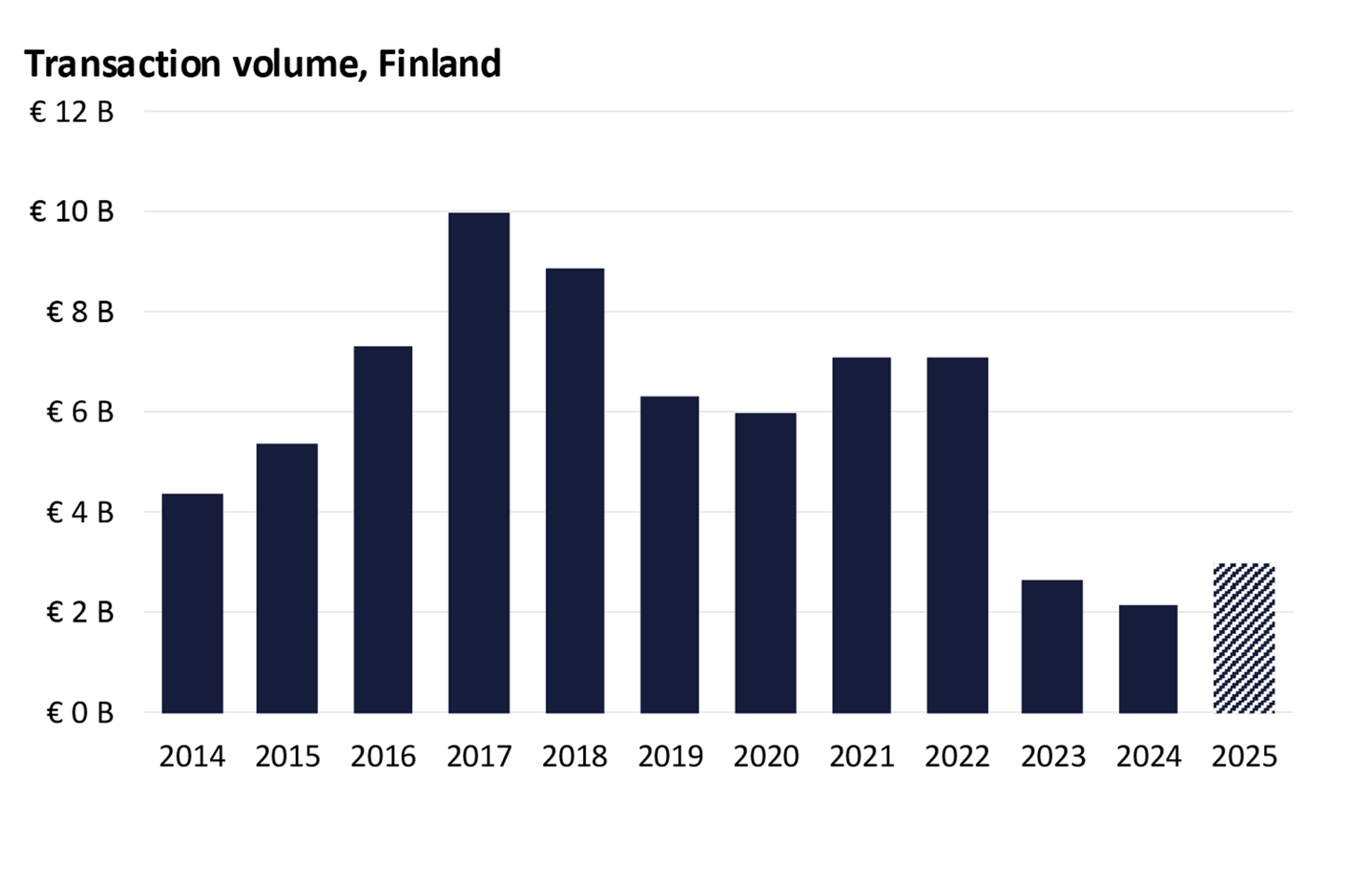

Recovery postponed: In 2024, Finland's transaction volume reached 2.2 billion euros, a 19% decline compared to 2023. Factors such as financing costs, differing pricing perspectives, and a reduced pool of active buyers have continued to impact transactions. However, there are indications that the cycle is beginning to shift. The real estate investment markets in the Nordics and Europe have shown increased activity, and Finland is expected to align with this trend.

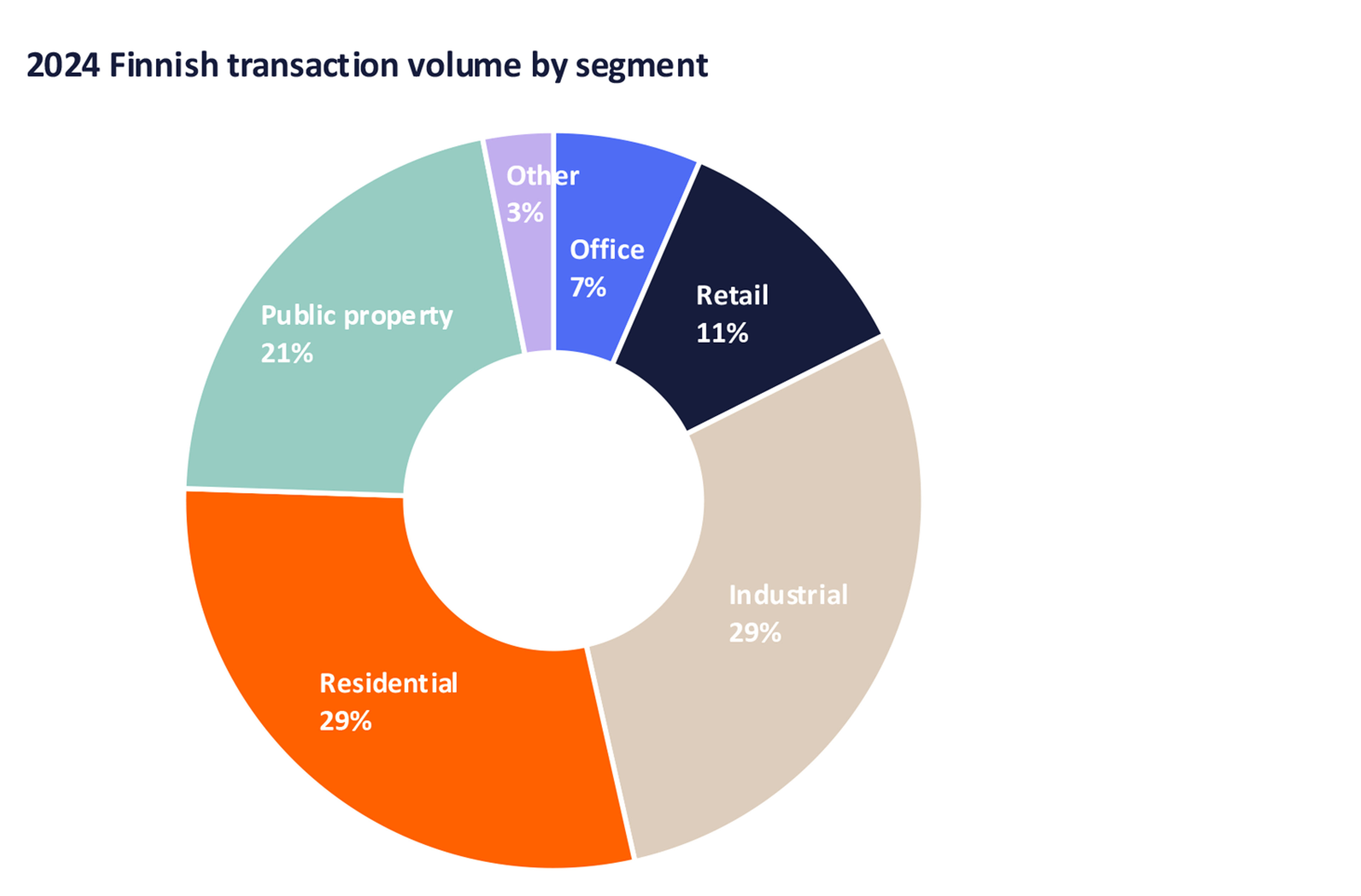

In the fourth quarter of 2024, €523 million transactions were recorded across all sectors in Finland. The transaction volume was 2.2 billion euros in the full year of 2024, a 19% decrease from 2023. Residential, logistics, and public properties comprised 80% of the total volume 2024. Retail was the only segment increasing in volume from the previous year. The office market has remained subdued throughout the year.

Financing costs, pricing view differences, and a narrowed pool of active buyers continued to affect transactions. Open-ended funds remained on the sidelines, institutional investors adopted a more cautious approach, and Nordic and international players were relatively passive. This has had an apparent effect on the very low transactional activity. Nordic and international investors are especially critical to driving market liquidity and stabilizing pricing in Finland. In 2024, the share of international investors was only 36%, while the 10-year average is 56%.

Cautious optimism in the transaction market

There is a sense of optimism, and investors' appetite for Finnish real estate is gradually growing. Professional investors are re-entering the market, numerous new investors have entered with various strategies, and Newsec has noted increased interest from international investors. Finland presents compelling opportunities, supported by robust urbanization trends and increasingly attractive prospects across various subsegments.

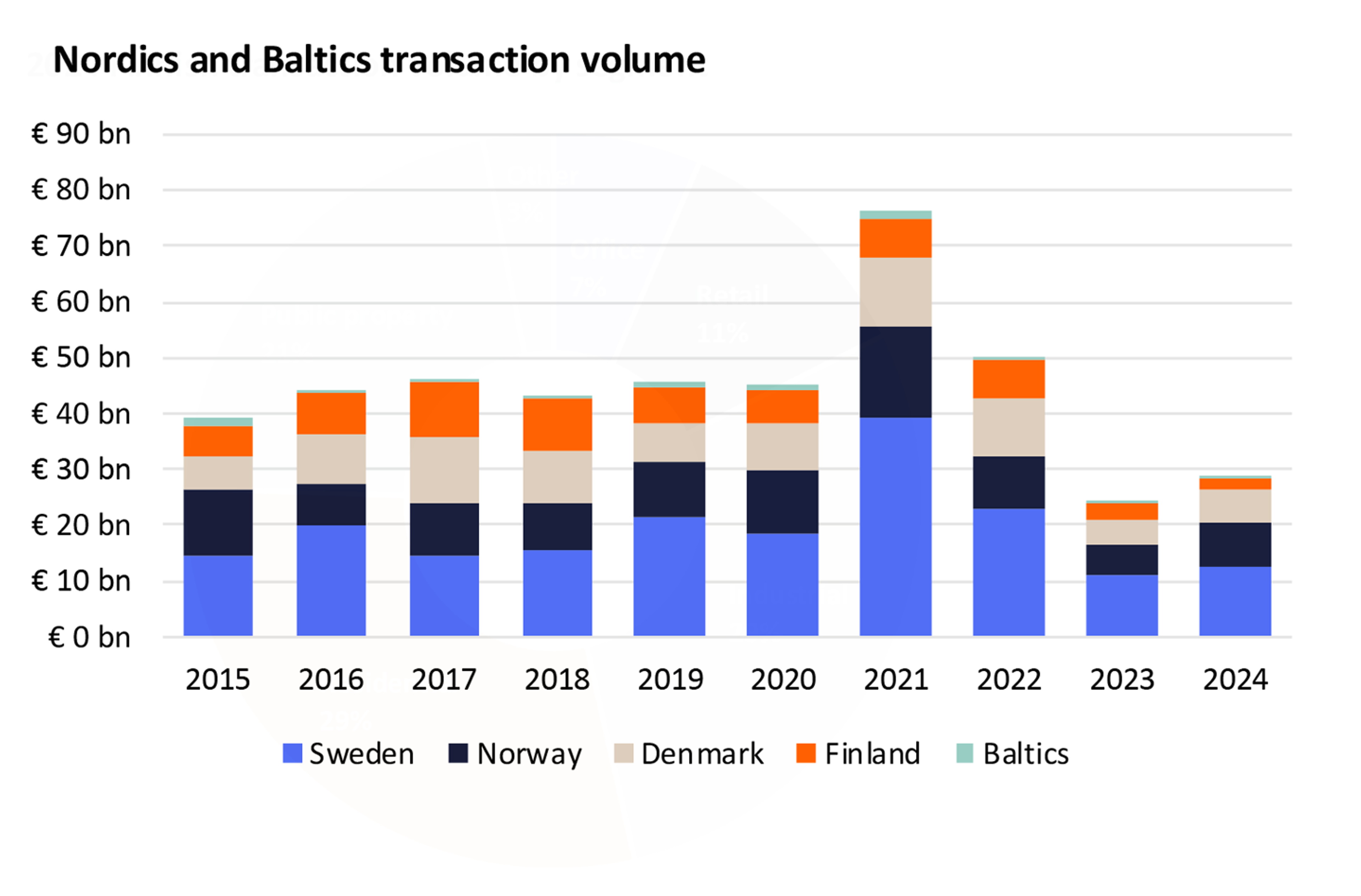

At the beginning of 2025, Finland's real estate investment markets are experiencing heightened activity. Newsec projects that transaction volumes in Finland will rise with trends observed across Europe. A positive shift has been noted in the European and Nordic real estate markets, with investments increasing compared to the previous year. Specifically, transaction volumes in the Nordics and Baltics increased by 23% in 2024 relative to the prior year.

Industrial and Logistics in the lead in Q4

The expected increase in transaction volume at the end of the year did not materialize in the fourth quarter, which experienced a 31% year-on-year decrease. Industrial and logistics properties represented 32% of the total volume for Q4 2024, amounting to €523 million. Public properties accounted for 26%, followed by residential at 15%, offices at 11%, and retail at 5%.

Key transactions in the fourth quarter of 2024 include Swiss Life's acquisition of the Ahlsell logistics property from Savills IM, Colony's purchase of the prime Helsinki office located at Fabianinkatu 9 from KanAm Grund Group, and Ficolo's acquisition of a data center property in Vantaa from Onvest for €47 million.

International investors accounted for 41% of the total investment volume in the fourth quarter, and 55% of transactions occurred in the Helsinki Metropolitan Area.

Beds, sheds, and meds led the way

The top 10 transactions in 2024 include residential, logistics, and healthcare properties. Moreover, residential and logistics have gained most of the investments in the downturn cycle 2023-2024. Investor appetite for these strategies will also remain robust in the next cycle. New and existing investors are entering the market, and there is an increase in interest from Core and Core+ and international investors to re-enter the Finnish real estate market. Opportunity drivers, such as continued urbanization, demographics, e-commerce growth, and rising purchasing power back these segments. There are also opportunities for investors looking for rebounding segments, such as prime offices and hotels, backed by demand for central locations and modern space and increasing global tourism.

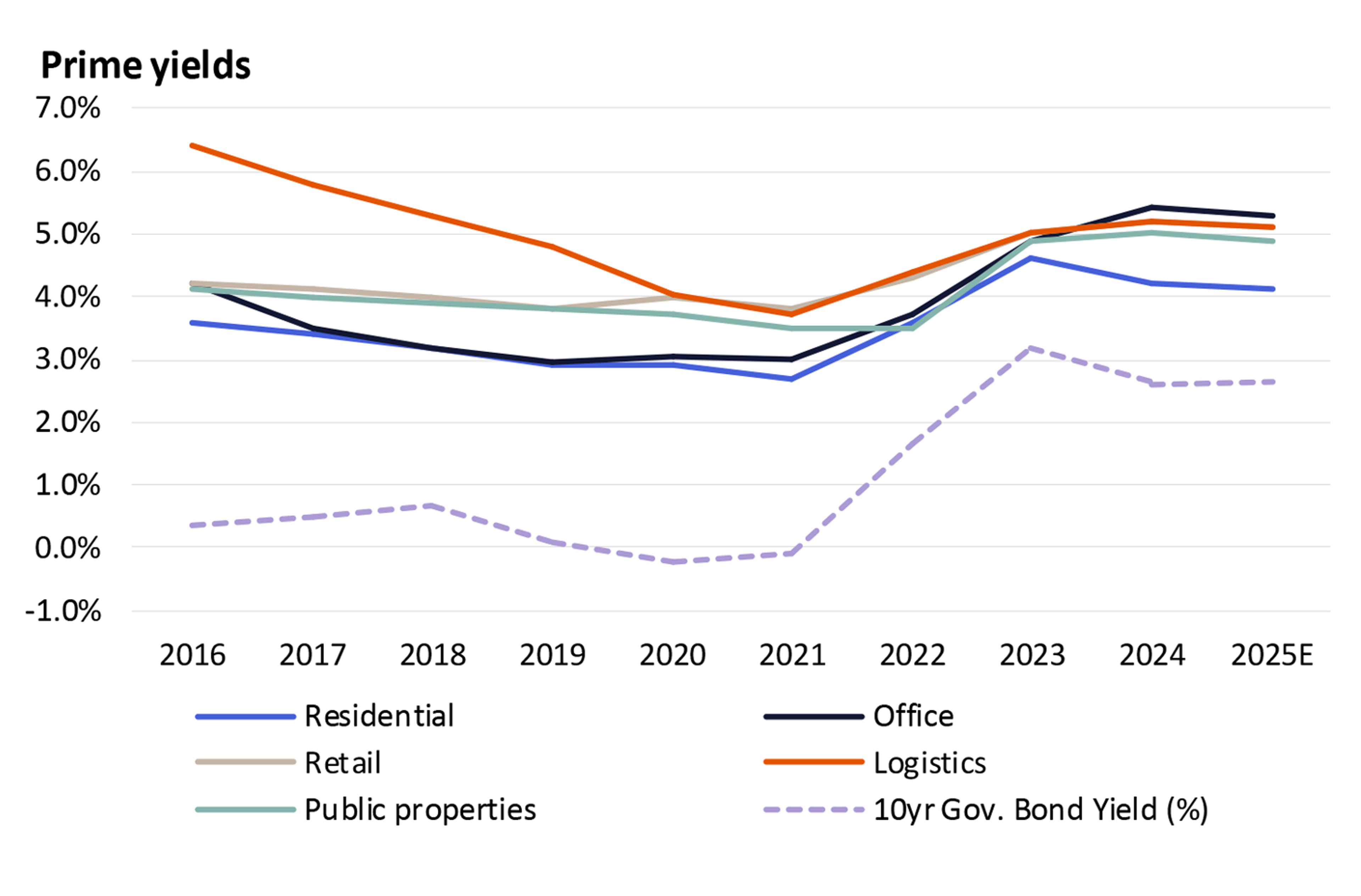

Yields to remain stable

Yields have aligned with financing costs, and Newsec's base case scenario anticipates stability in prime yields following the recent correction. In 2024, yield compression was observed in the residential and logistics sectors, with residential yields concluding the year at 4.2% and logistics at 5.2%. The prime office yield decompression trend persisted in the fourth quarter, resulting in a prime yield of 5.4%. Grocery-anchored retail maintained a yield of 5.2%, while public properties recorded a yield of 5.0% in Q4.

While specific segments have started to see a yield compression, a broader downward adjustment is not expected in the short-term. Newsec anticipates stable prime yields across most segments with minimal movement, albeit with a small room for compression in the most sought-after asset classes.

By January 2025, the European Central Bank has lowered its key interest rate to 3.0% and is anticipated to maintain this easing trend throughout the year. Analysts foresee additional rate cuts, which could bring the deposit rate down to 2.0% by the close of 2025. These reductions are poised to be instrumental in yield compression, as enhanced financing conditions will likely reignite investor interest in segments with the most investor demand. There is currently no justification for a substantial compression of yields, however, as the forecast for government bond yield movements remains relatively stable.

Outlook for 2025

The Finnish real estate market is set for a gradual recovery in 2025, supported by several key factors aligning to restore stability and growth. Declining interest rates, increasing household purchasing power, and a strengthening macroeconomic environment are laying the groundwork for renewed confidence. Crucially, the return of international investors, coupled with property valuations catching up, is bridging the gap between buyer and seller expectations, creating a more favorable transaction landscape.

Investment volumes are projected to rise to €3.0 billion in 2025—a robust 40% increase from 2024. This optimistic forecast is driven not only by the economic tailwinds but also by specific structural drivers. For instance, certain delayed transactions from 2024 are expected to materialize in 2025, and open-ended funds under pressure to meet redemption requests are likely to increase asset divestments. These motivated sales will further stimulate deal activity, presenting opportunities for well-capitalized investors.

The attached reports provide more detailed information on developments by segment for the fourth quarter of the year.

Newsec Industrial and Logistics Q4/2024

Newsec Public Properties Q4/2024

More information:

Valtteri Vuorio

Head of Research,

Newsec Advisory in Finland

valtteri.vuorio@newsec.fi

+358 40 705 3093

The downloadable market reports provide basic information on the real estate market in the previous quarter. More detailed information by segment and submarket is available in Newsec's on-demand market reports. Newsec provides the most comprehensive information on the residential, office, and logistics market. To find out more, contact markkinakatsaukset@newsec.fi.

Yksityiskohdat

Julkaisupäivä

250128

Muoto