Newsec Finnish Property Outlook spring 2024 -

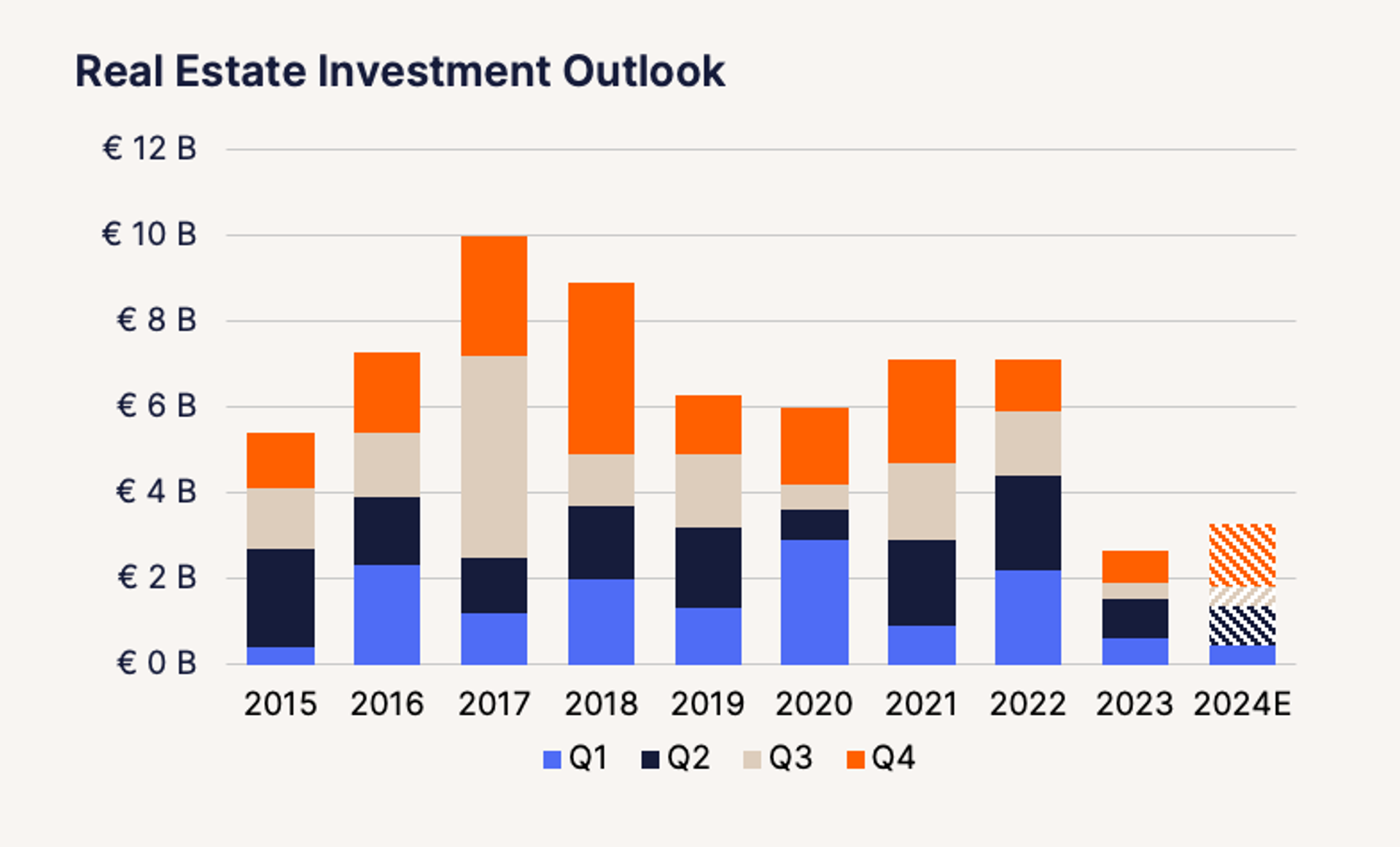

Investment activity increasing gradually but moderately.

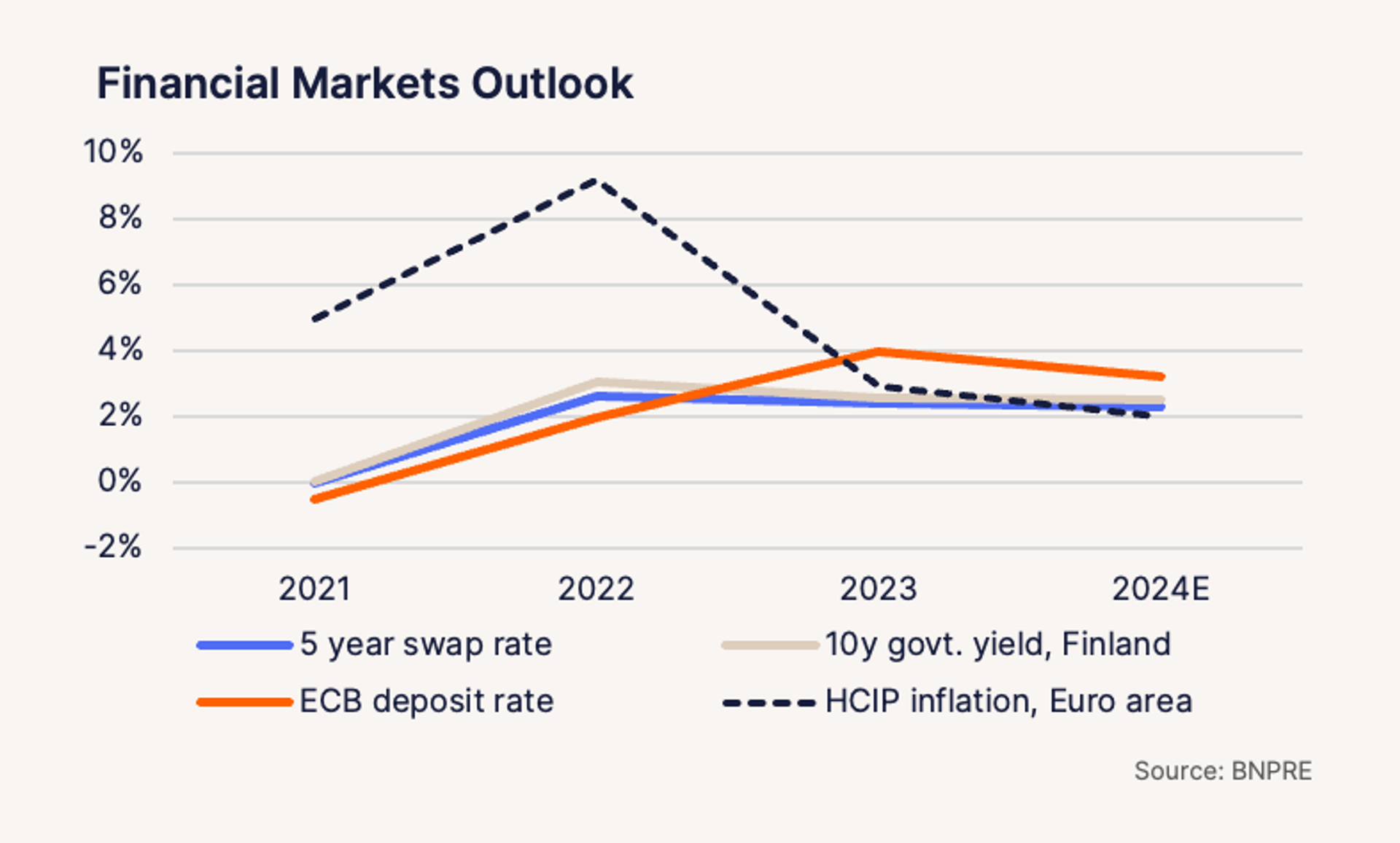

The year 2023 did not materialize in the real estate market as we had expected. The European Central Bank raised its policy rate no less than six times, putting the brakes on economic growth, consumer behavior and the performance of the real estate market. In 2024, we expect market performance to improve towards the end of the year. Our view is that the European Central Bank will cut its policy rate in June, which will encourage investors to return to the real estate investment market.

Newsec's Finnish Property Outlook offers a cross-section of the current year's real estate investment market outlook.

Key findings

- The transaction volume in Q1 2024 was 450 million euros, which is 24% lower compared to the corresponding time in 2023.

- Financing costs and differences in pricing perceptions are still burdening the recovery of liquidity, and there is no relief for this until the interest rate curve heads down.

- In the Helsinki Metropolitan Area’s residential rental market, the oversupply of small apartments seems to be easing slightly, as occupancy rates are improving.

- In the office market, reduction in space requirements is reflected in an investment in location and quality.

- Demand for logistics properties has remained at a good level even in a challenging market.

- Fewer public properties investors are willing to invest in small municipalities.

- Strengthening purchasing power supports the growth of private consumption.

Recent forecasts suggest that the European Central Bank's policy rate will tick lower from summer onwards. The availability and price of debt capital has constrained real estate transactions for almost two years. While lenders are not expected to ease their conditions in the coming months, the outlook improves towards the end of the year as interest rates fall.

This could trigger a new cycle in the real estate market. Some real estate investors have been cautiously optimistic. Currently, we see a slight increase in the offers for the best properties at the moment. For the year as a whole, we expect a moderate increase in investment volumes compared to last year.

Long-term tenant demand drives investment demand

Current investment demand is particularly targeted towards residential, industrial & logistics and public properties. These sectors offer promising long-term prospects for tenant demand. In the short term, these sectors face various challenges, which is a constrain on investments.

The office market is still in a post-pandemic period of hybrid work restructuring. Therefore, both investors and the debt market are selective about offices.

Q1/2024 has been active for retail compared to the same period last year. More broader transaction activity in this sector is not expected to occur this year.

The yield correction appears to be almost complete for the prime properties - especially for residential. In the first quarter of 2024, there has been no further changes to prime yields after six quarters of decompression. We expect downward pressure on prime yields as the interest rates decline.

CSRD becoming part of real estate investors' everyday lives.

Sustainability reporting requirements are now strongly shaping practices in the real estate sector. The Corporate Sustainability Reporting Directive (CSRD) is the EU's new sustainability reporting directive. The reporting requirement will be progressively extended to a large number of companies this year. Sustainability work is full of different acronyms but the CSRD will act as a unifying element and pull a jungle of acronyms under one umbrella. More on this in our report.

Download the reportYksityiskohdat

Julkaisupäivä

240410

Muoto

Sivut

Kieli

English