Newsec Property Outlook Finland autumn 2024 -

The real estate investment market has been passive for a long time since central banks began raising interest rates starting in Q3/2022. Now, there are signs of awakening in the market with positive signals.

The Finnish real estate investment market is awakening after a long winter slumber.

The real estate investment market has been passive for a long time since central banks began raising interest rates starting in Q3/2022. Now, there are signs of awakening in the market with positive signals. The interest rate cuts initiated by central banks have brought a positive message. The European and Nordic real estate investment markets have become more active, with Finland following in pursuit.

Newsec Property Outlook Finland provides insight into the Finnish real estate market for the remainder of 2024 and 2025.

Key findings

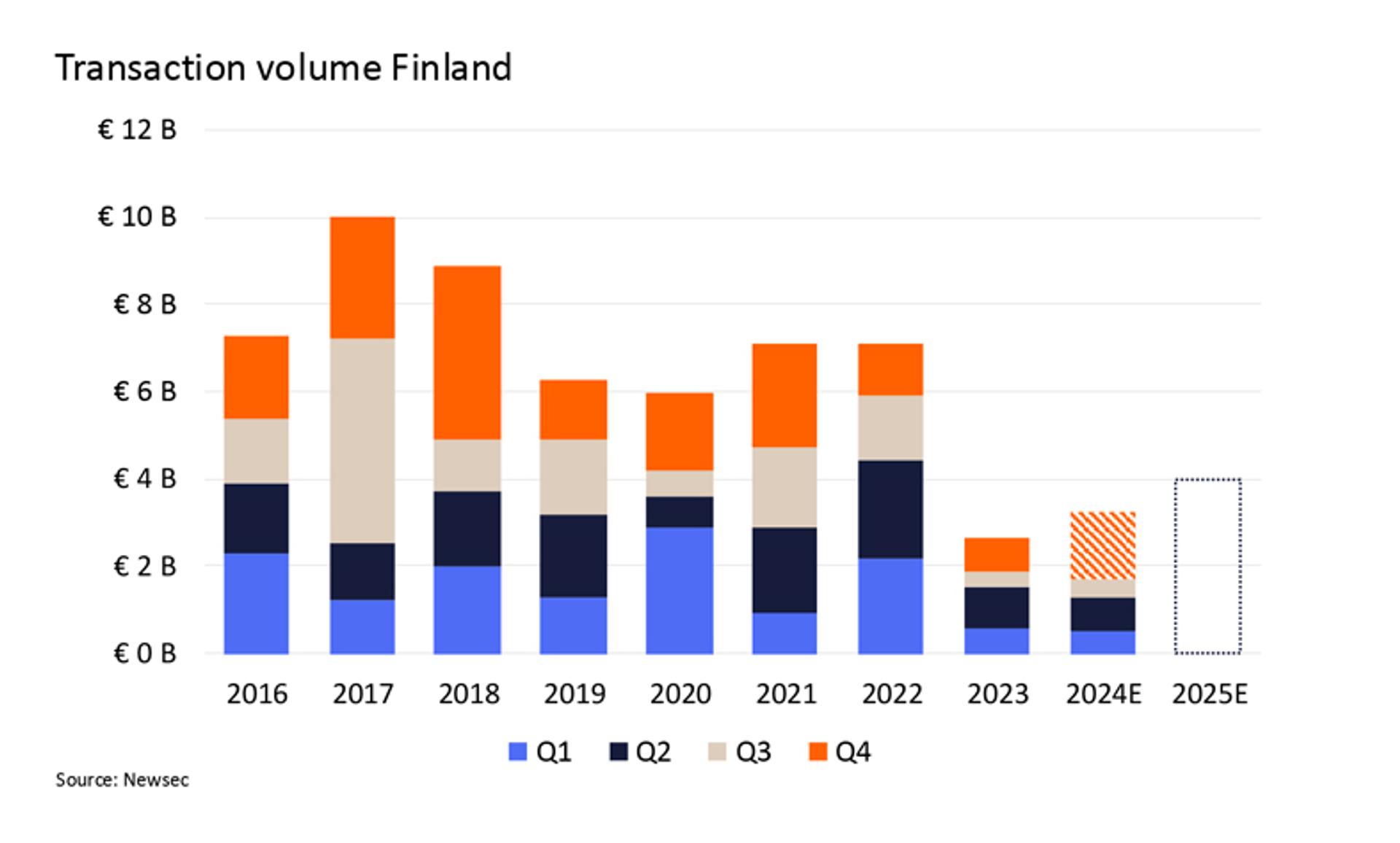

- In Q1-Q3 2024, Finland's transaction volume was 1.6 billion euros, representing a 16% decrease compared to the same period in 2023. Financing costs and pricing view differences continue to affect transactions, but the situation appears to be easing as the interest rates decline.

- In the Nordics, Norway (+22%) and Denmark (+3.2%) have already surpassed last year's levels, while Sweden (-1.5%) is still experiencing a slight decline in the first three-quarters of transactions.

- The European real estate investment markets have also become active, with H1 2024 transaction volume being 7% higher than the same period last year.

- Newsec forecasts that Finland's transaction volumes will grow alongside developments in the rest of Europe.

- In the Helsinki Metropolitan Area’s rental markets, the oversupply of apartments has begun to ease, reflected in improving occupancy rates.

- Office investment volumes remain at a low level.

- The demand for logistics properties has remained strong, and transaction volumes are recovering.

- The volumes of public properties have increased compared to the same period last year.

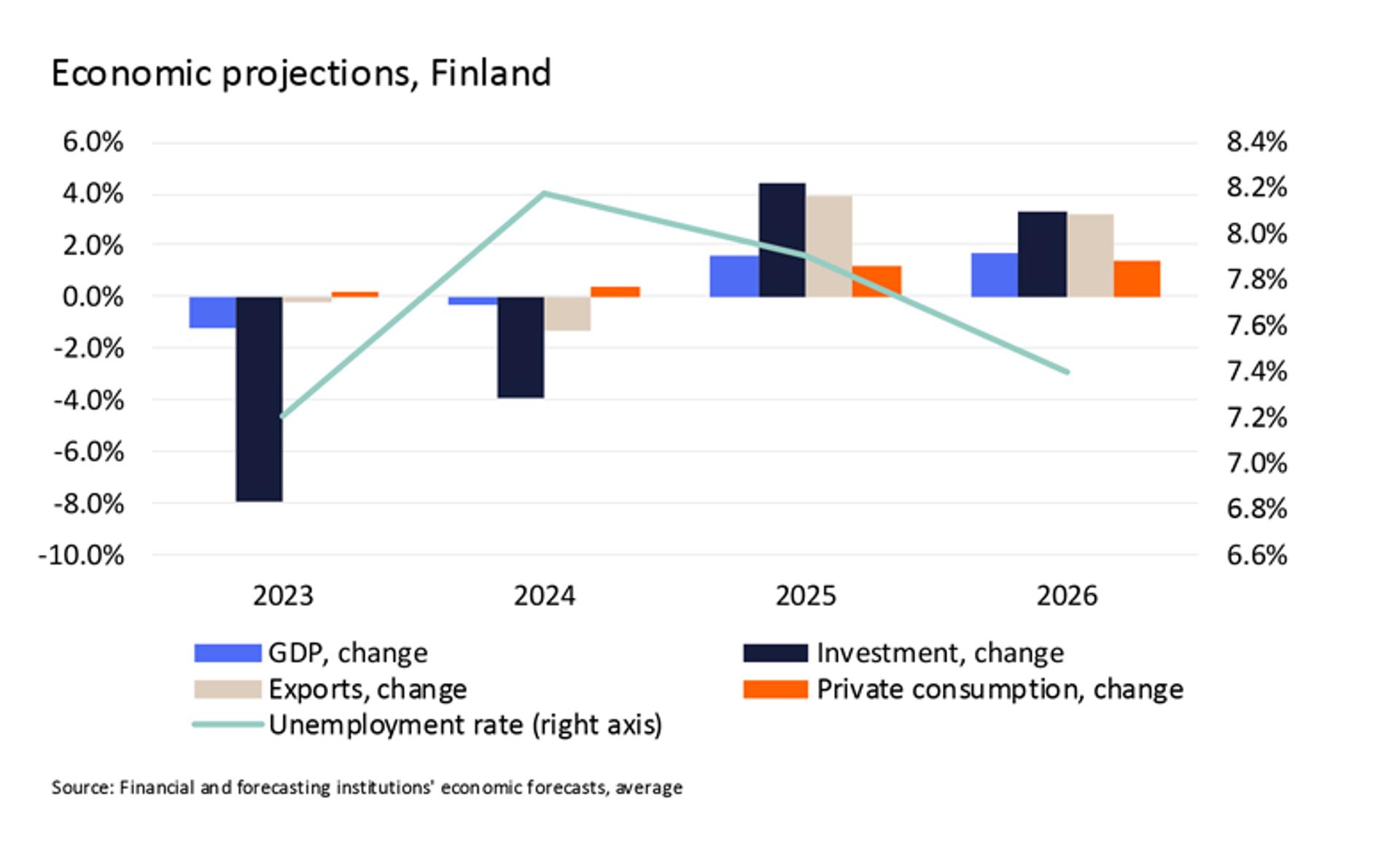

- Finland's economy is set to shift to a moderate growth trajectory from 2025 onwards, supporting the recovery of real estate transactions.

The European Central Bank began lowering interest rates in June 2024. Recent forecasts indicate that the key interest rate will continue to decrease quarterly until the end of 2025. The availability and cost of financing have constrained real estate transactions for nearly two years. As the situation improves, an increase in liquidity can be expected in the Finnish real estate investment market.

The ECB is expected to lower the deposit rate by about one percentage point by the end of 2025. However, the outlook beyond 2025 is more uncertain, although it is generally estimated that interest rates will not return to previous low levels in the medium term.

The medium-term outlook for the Finnish economy is positive, supporting the real estate sector. Growth in employment and purchasing power promotes consumption, and the recovery of investments and exports strengthens market development.

Economic and interest rate outlooks indicate a gradual recovery. According to Newsec's forecasts, transaction volume is expected to grow moderately in 2024. Both international and domestic investors are beginning to return to the market, and a reasonable number of transaction processes are anticipated for the end of the year. Preliminary estimates suggest that transaction volume will increase by about 25% in 2025.

Residential transaction volumes leading the way

Logistics, residential, and social infrastructure remain the most popular sectors for real estate investors. These sectors offer a promising long-term outlook for tenant demand.

Residential properties continue to dominate investment demand. They have outperformed other sectors throughout the recent tighter monetary policy cycle. Since the third quarter of 2022, the cumulative transaction volume for residential properties has reached 1.9 billion euros, approximately 30% more compared to the next largest sector, logistics.

Newsec has set yield compression for the prime residential properties in line with completed transactions over the year. We expect the yield decompression for the best properties to be complete or nearly complete for other sectors.

The double materiality assessment as a guide in the real estate sector

The Autumn Newsec Property Outlook Finland examines in detail the new obligations and opportunities presented by the Corporate Sustainability Reporting Directive (CSRD). The directive mandates the double materiality assessment, which enables the identification of risks and opportunities and transparent communication about the business's environmental and social impacts.

Newsec's experienced sustainability team offers comprehensive services to support clients in managing and developing sustainability.

More information

Valtteri Vuorio

Head of Research

valtteri.vuorio@newsec.fi

+358 40 705 3093

Yksityiskohdat

Julkaisupäivä

241010

Muoto

Sivut

Kieli

English